Build your mortgage business, your way

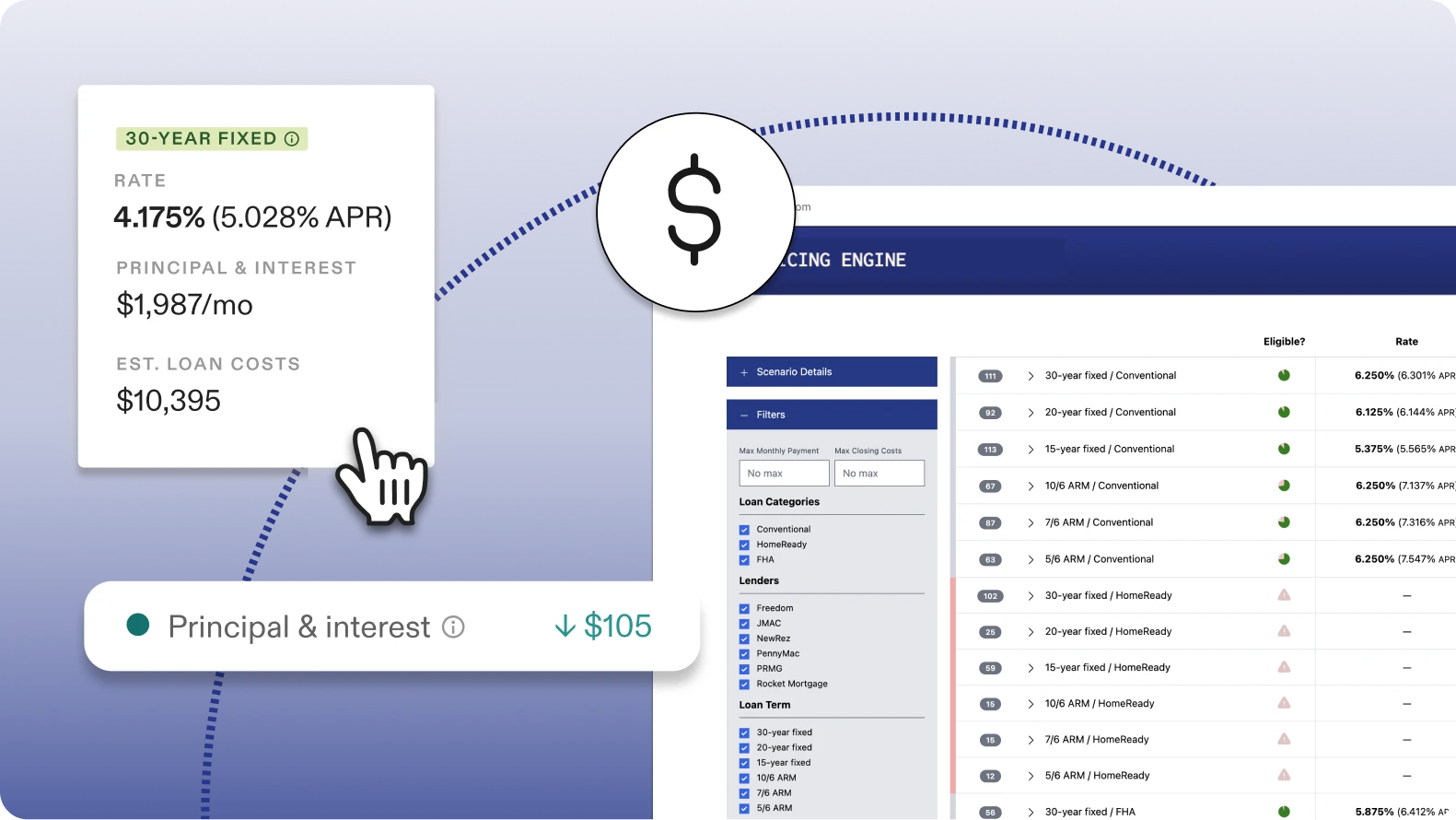

The Morty Platform gives you the independence to start or scale your mortgage brand with the resources, infrastructure and technology you need to be profitable in today’s mortgage industry.

Request Demo

“The Morty Platform provides tools to streamline your processes and enhance your ability to provide tailored solutions to clients.”

Morty powers a new mortgage vertical for a fintech company that enables liquidity access to non-traditional assets.

For Brokerages and Startups

Chat with our Sales Team. Tell us about your current mortgage setup, your use case and your business goals.

Pick your Team and Footprint. Don't worry, you can change this later! It's important for us to know if you want to start in 1 state vs 20 and similarly if you're a solopreneur or a 200 person company.

Sign Contract and Submit Setup Fee. Let's start working together!

NMLS Sponsorship and Background Check. Give Morty access to your LO's NMLS account so they can originate loans through our platform.

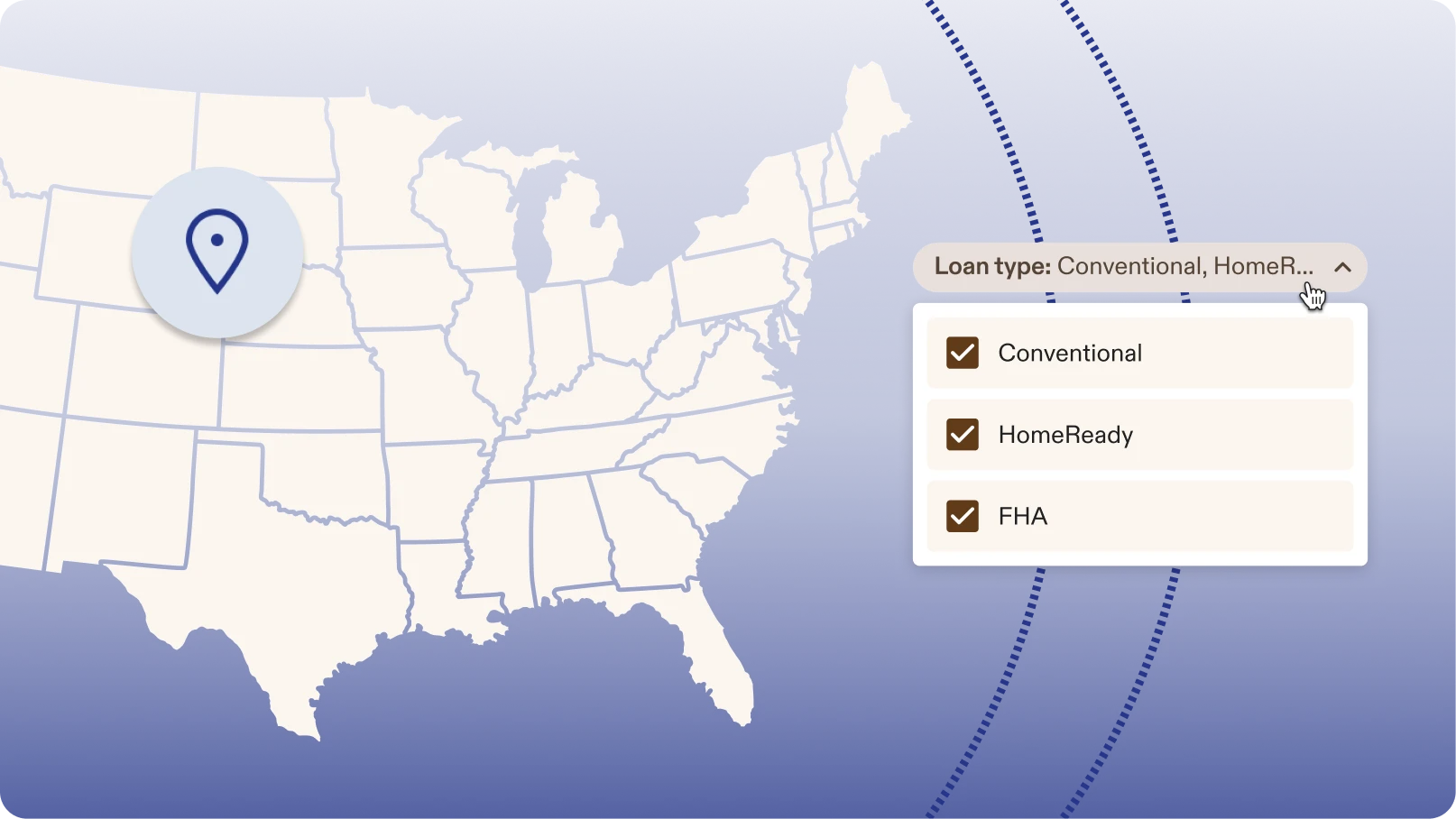

Marketplace Configuration. Morty team to set your margins, review lenders and loan programs, create commission splits and perfect your own version of our mortgage marketplace.

Product Marketing Implementation. Work with the Morty onboarding team to identify your top-of-funnel marketing and acquisition channels, implement your digital sales funnel and create and perfect your co-branded customer experience.

Onboard Team. Begin onboarding your team onto the Morty platforms including loan officers and support staff

Start Inviting Clients!! Leverage our invitation system to start inviting your client to Morty! You'll get notified as soon as they sign up.

Find the right plan for you

Feature comparison

| Feature | Foundation tier | Producer tier | Business tier |

|---|---|---|---|

| Full-stack technology suite | | | |

| Processing and fulfillment | | | |

| Comprehensive loan offerings | | | |

| Loan compensation | up to 100bps | up to 150bps | up to 200bps |

| Co-branding | | | |

| Lender configuration | | | |

| Team management | | | |

Frequently asked questions

Common questions about Morty, how we operate and what’s included in joining the Platform. Reach out to team at platform@morty.com with any additional questions.

- Is Morty a mortgage lender or broker?

Morty is an online mortgage broker. As a broker we have access to the universe of loan products so you can serve your clients better.

- Can I get health benefits through Morty?

Unfortunately we are not able to offer health benefits to Platform LOs right now, but may in the future.

- Does Morty sponsor my pre-licensing education and application fees?

Morty covers the cost of test prep materials through our Blueprint Licensing and Activation Accelerator.

- How long does it take to get sponsored by Morty?

Once you’re licensed, based on your state, it can take a few hours to a few weeks to get sponsored and activated on our Platform.

- What is the process for getting licensed in additional states?

With Morty the process is fast and easy — complete any state education requirements and submit your sponsorship to NMLS. Foundation tier covers two state licenses. You can add more state licenses through our Platform Add ons or by upgrading to Producer Tier.

- Do you work with down payment assistance programs?

Yes! Morty offers a variety of DPA programs including through VA and USDA offerings.

- Can I purchase leads through Morty?

Yes, you can purchase leads through Morty through our Lead Bundles or as part of Platform Premium.

- Does Morty provide any marketing?

Yes! Morty provides personalized landing page, business cards and one-pager to all Platform LOs. Morty also has a robust marketing library that LOs can leverage which includes things like: social media banners, sample instagram posts and various logos.

- Are there any fees to join the Morty Platform?

Morty charges a monthly fee for access to our technology suite, lender infrastructure and marketing resources. Foundation, our entry level tier, costs $129/mo with no setup fee. If you're interested more control over your margins or you're ready to build your digital brokerage, consider our higher business tiers.