A new zero-down option, plus more ways to put down less on your home

This week, Bank of America announced a “no-down” mortgage program called the Community Affordable Loan Solution, aimed at closing the racial homeownership gap. It’s the latest of various no- and low-down payment mortgage options, as growing numbers of buyers seek more affordable paths to becoming homeowners.

Government-backed options such as FHA loans are among the most well-known, offering buyers more lenient credit score requirements and down payments as low as 3.5% – a good fit for many first-time homebuyers. VA and USDA loans also have varying low and no down payment options for qualified military veterans and homebuyers in rural communities.

But there are also a number of conventional options that can offer similar benefits. Fannie Mae’s HomeReady program, for example, offers first-time buyers who meet certain income requirements the option to put down as little as 3%. Fannie Mae’s standard 97% LTV mortgage offers similar terms to buyers without the income restrictions.

Other non-traditional options such as rent-to-own and down payment assistance programs can also make it possible to buy a home without having a significant down payment saved. While rates, inflation, and home prices may be out of your control, it’s exploring other tools and solutions that can help to make homeownership more affordable.

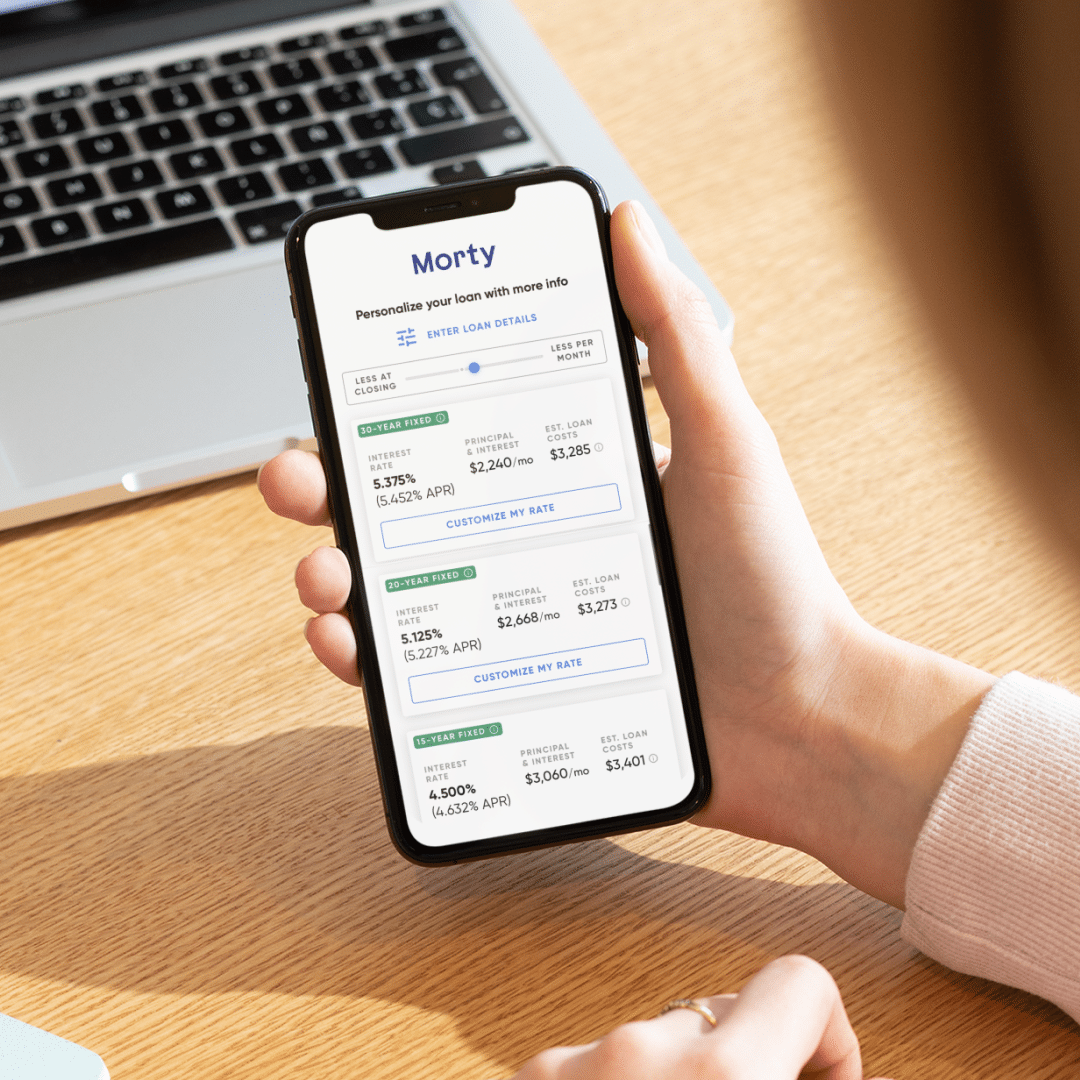

– Robert Heck, Vice President of Mortgage @ Morty

Which low-down payment option is right for me?

| Home Ready | FHA | Conventional 97 | |

|---|---|---|---|

| Gov’t Backed | ❌ | ✔️ | x |

| Min. Down Payment | 3% | 3.5% | 3% |

| Cancellable Mortgage Insurance | ✔️ | No, if <10% down | ✔️ |

| Required Education Course | ✔️ | ❌ | ✔️ |

| DTI Limit | 50% | 43% | 43% |

| Min. FICO score | 620+ | 500+ | 620+ |

| Total Loan Limit | $647,200 | $420,680 | $647,200 |

| Qualifying Income Limit | 80% AMI* | None | None |

Chart info based on the majority of typical cases.