We’re a little over a month into 2025 and the housing market is already showing a range of trends. Let’s take a look at where things stand!

Mortgage Rates Hold Steady. The average 30-year fixed mortgage rate is holding steady around 7%. While still elevated compared to historical lows, the predictability provides homebuyers a clearer outlook as they plan their next steps.

Home Price Cuts: While home prices remain higher than they were a year ago, about 33.1% of sellers reduced their listing prices in late January, presenting an opportunity for homebuyers.

Inventory Levels Improving: Builders ramped up new construction in 2024 and unsold inventory of homes on the market is nearly 30% greater than a year ago. While inventory remains tight, overall we’re entering the year on a brighter spot and the trend is expected to continue.

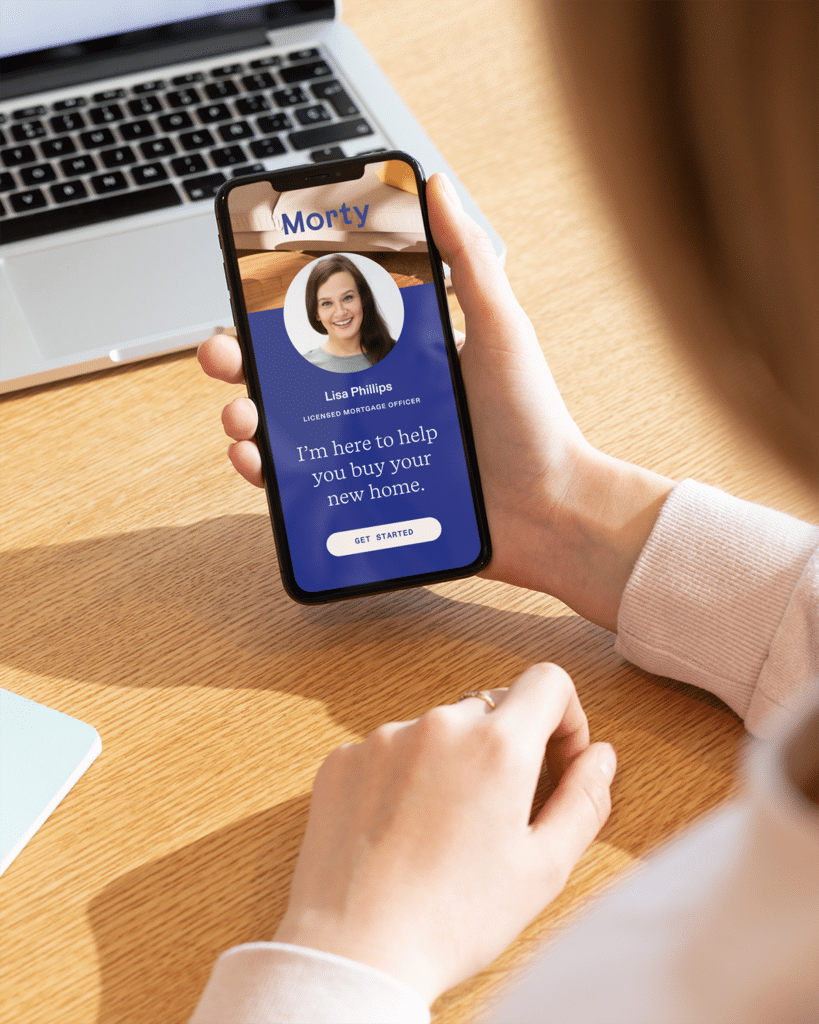

What’s Next For Homebuyers? For homebuyers considering entering the market this year, it’s an excellent time to explore options. Morty’s tools and loan officers are here to support them every step of the way:

- Check Rates: Keep your finger on the pulse and see where rates stand for purchase and refi.

- Plan Your Budget: Create a free account to access Morty’s Cost Explorer to see what you can afford.

- Talk to an Expert: Connect with a local loan officer to discuss your unique goals.

The housing market is dynamic, but with the right tools, homebuyers can confidently take the next step towards their goals. Here’s to homebuying in 2025!