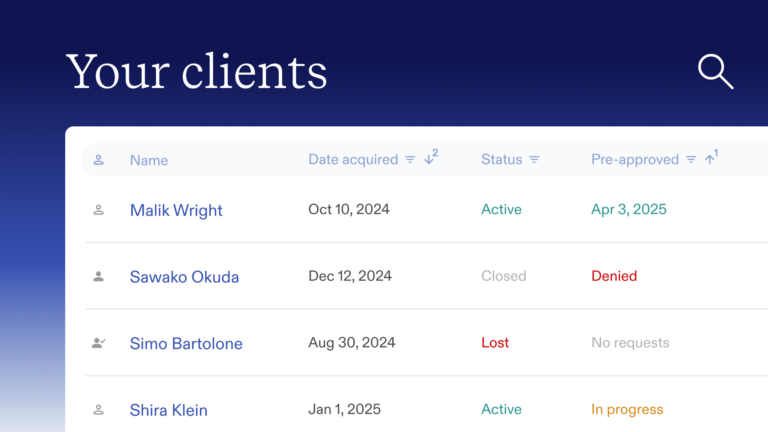

Managing your clients’ finances is more comprehensive with our latest product update. Morty now supports all asset and income types, giving you a more complete financial picture for each borrower.

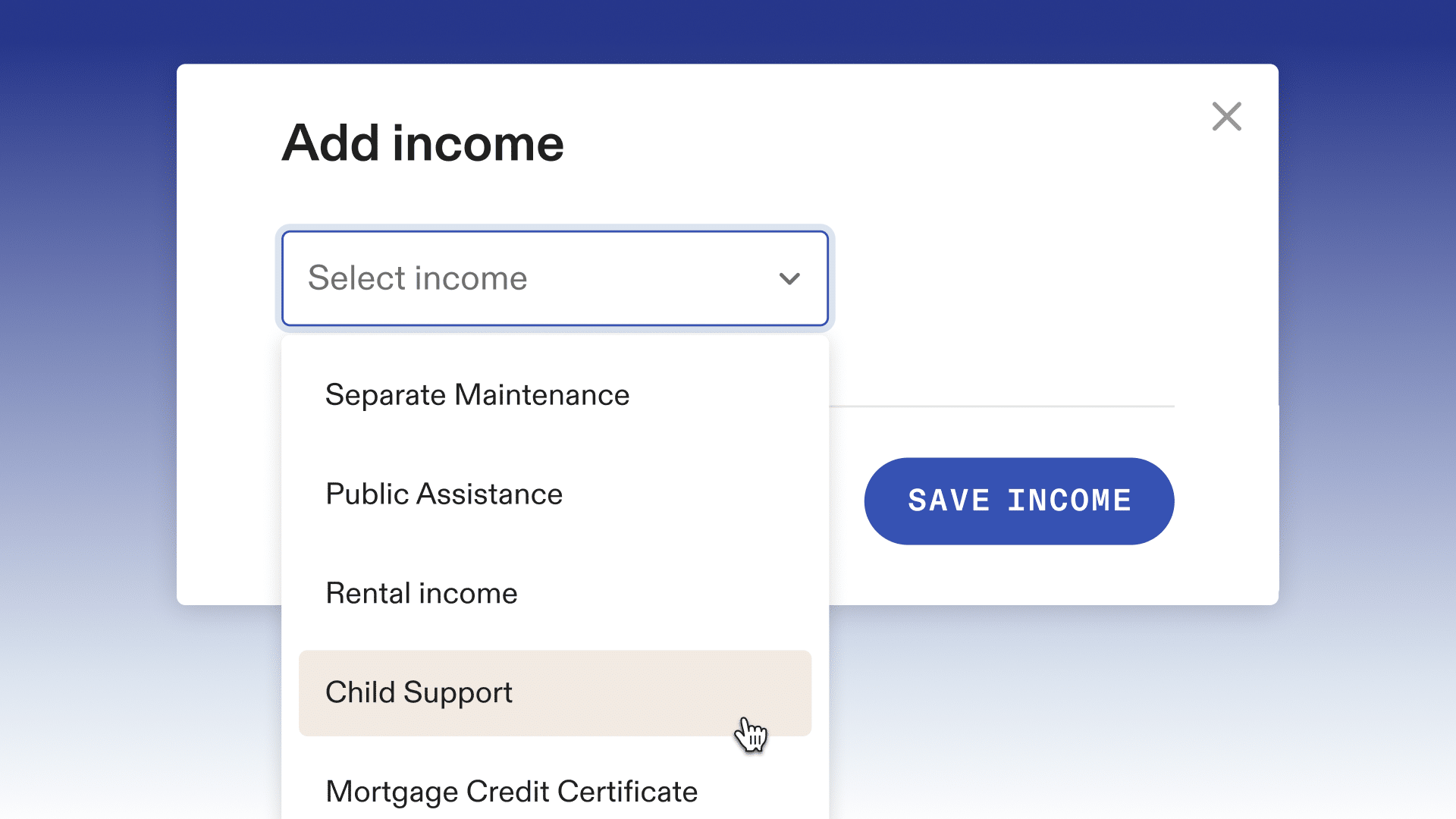

Now, your borrowers can declare any financial source in their pre-approval or application—including unemployment benefits, child support, equity holdings, and more.

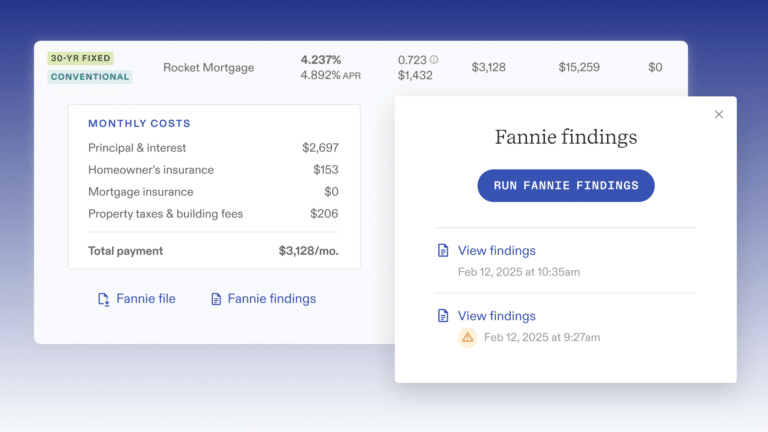

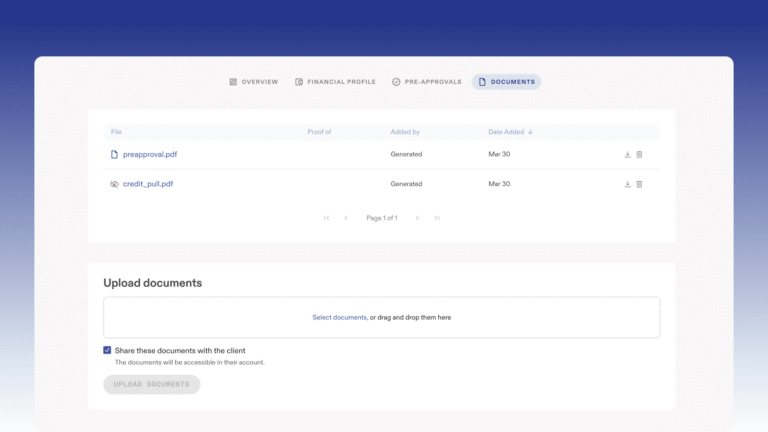

These new details are seamlessly integrated into Hemlock, allowing you to manage them directly in your clients’ financial profiles. They’re also included in 1003 applications and Fannie Mae files, making loan registration, rate locking, and eligibility assessments smoother than ever.

Any required verification documents for these new income and asset types will be requested automatically through the closing tracker, so you can stay focused on guiding your clients to closing.

With this update, you gain greater flexibility, better insights, and a more streamlined loan process for your borrowers.