Becoming a Loan Officer through Morty’s Platform: Q+A

Resources > FAQs

Are you a real estate agent considering becoming licensed as a mortgage loan officer (MLO)? Great! Unlock your potential for success with our comprehensive guide. From increased commissions to enhanced client service, there are numerous benefits to getting dual-licensed.

Here are some common questions that can help as you move forward. Contact us to learn more.

What is the process to become a licensed mortgage loan officer?

Generally, the process to become a licensed MLO involves completing 20 hours of pre-license education, passing a national exam, and fulfilling state-specific requirements. The specific requirements may vary by state.

How long does it take to become licensed?

The timeline can vary depending on individual circumstances, but generally, you can expect to complete the licensing process in a few weeks to a couple of months.

Will managing both roles as a realtor and a mortgage loan officer be overwhelming?

Our online platform is designed to streamline your work and handle back-end processes, including document collection, underwriting, and loan processing. This allows you to focus on nurturing client relationships and closing deals, making the dual role manageable and efficient.

Can I get licensed in more than one state?

Yes, the new regulations allow for cross-state licensing. This offers you the opportunity to expand your business reach and tap into new markets as you wish.

What support does your platform provide to newly licensed mortgage loan officers?

We provide ongoing training and support to help you navigate the licensing process, understand mortgage products, and hone your skills. We are committed to ensuring you transition smoothly and confidently into your expanded role.

How can I start the process of becoming a licensed mortgage loan officer?

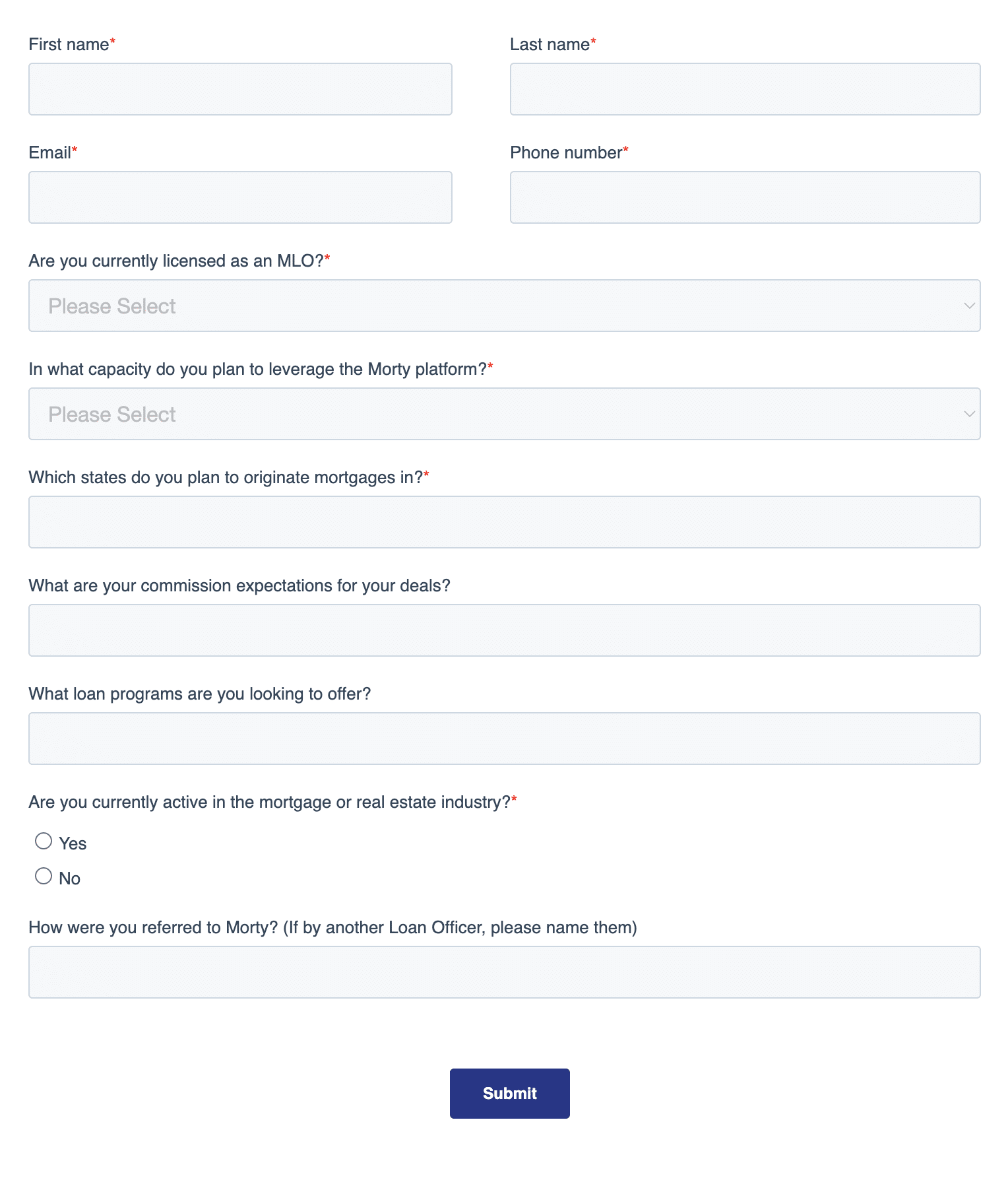

You can start by signing up on our platform. Our team will guide you through the necessary steps to begin your journey towards becoming a licensed mortgage loan officer.