With almost 40,000 licensed loan loan officers and 100,000 home sales in Pennsylvania, establishing a mortgage brokerage in Pennsylvania is an exciting opportunity. The first step to setting up a brokerage in Pennsylvania is crucial, you must obtain the necessary licenses. The licensing process is essential for ensuring that your operations comply with state regulations and that you can legally provide mortgage services. In this guide, we’ll walk you through the key steps to get licensed as a mortgage broker in the state of Pennsylvania.

Fulfill Licensing Requirements

The Pennsylvania Department of Banking and Securities is the regulatory body overseeing mortgage-related activities in the state. Before venturing into becoming a licensed mortgage broker, it’s essential to start as a licensed loan officer. If you’re not yet licensed, Morty offers comprehensive support through our Blueprint offering, guiding you through the pre-licensing process and providing assistance with the SAFE exam. Ensure you’ve fulfilled the educational requirements necessary for a loan officer license in Pennsylvania.

Attain the Required Work Experience

In addition to education, many states, including Pennsylvania, require candidates to have practical experience in the mortgage industry. This could involve working as a loan officer, loan processor, or in a related role.

Complete Background Checks

Expect a thorough background check as part of the licensing process. This includes a criminal background check and a credit report. Ensure your financial history is in good standing, as it may impact your eligibility for licensure.

Submit Application and Fees

Once you’ve met the educational requirements, gained the necessary experience, passed the exam, and cleared background checks, submit your application for a mortgage broker license to the Pennsylvania Department of Banking and Securities. Be prepared to pay the required licensing fees, which can vary.

Obtain a Surety Bond

Many states, including Pennsylvania, require mortgage brokers to obtain a surety bond as part of the licensing process. The bond serves as a form of financial protection for consumers. The amount of the bond varies, so check the specific requirements with Pennsylvania Department of Banking and Securities.

Submit Quarterly Reports to NMLS

Every quarter, NMLS requires you to submit a Mortgage Call Report (MCR). MCRs provide a detailed overview of a mortgage company’s or individual’s lending activities, financial performance, and compliance with regulatory requirements. These reports serve as a vital tool for regulatory bodies to monitor and assess the mortgage industry, ensuring adherence to applicable laws and safeguarding the interests of consumers.

Complete State Examinations

Every state, including Flordia, will randomly select companies to complete state examinations. These exams are similar to the MCR but can include more detailed requests like sample borrower correspondence.

Maintain Continuing Education

After obtaining your license, the learning process doesn’t stop. Pennsylvania, like many states, requires mortgage professionals to complete continuing education courses to stay informed about industry updates, regulations, and best practices.

Renew Your License

Mortgage broker licenses typically have a renewal period, often on an annual basis. Ensure you stay on top of license renewal requirements, including any continuing education credits, to maintain your legal standing.

Work with Morty

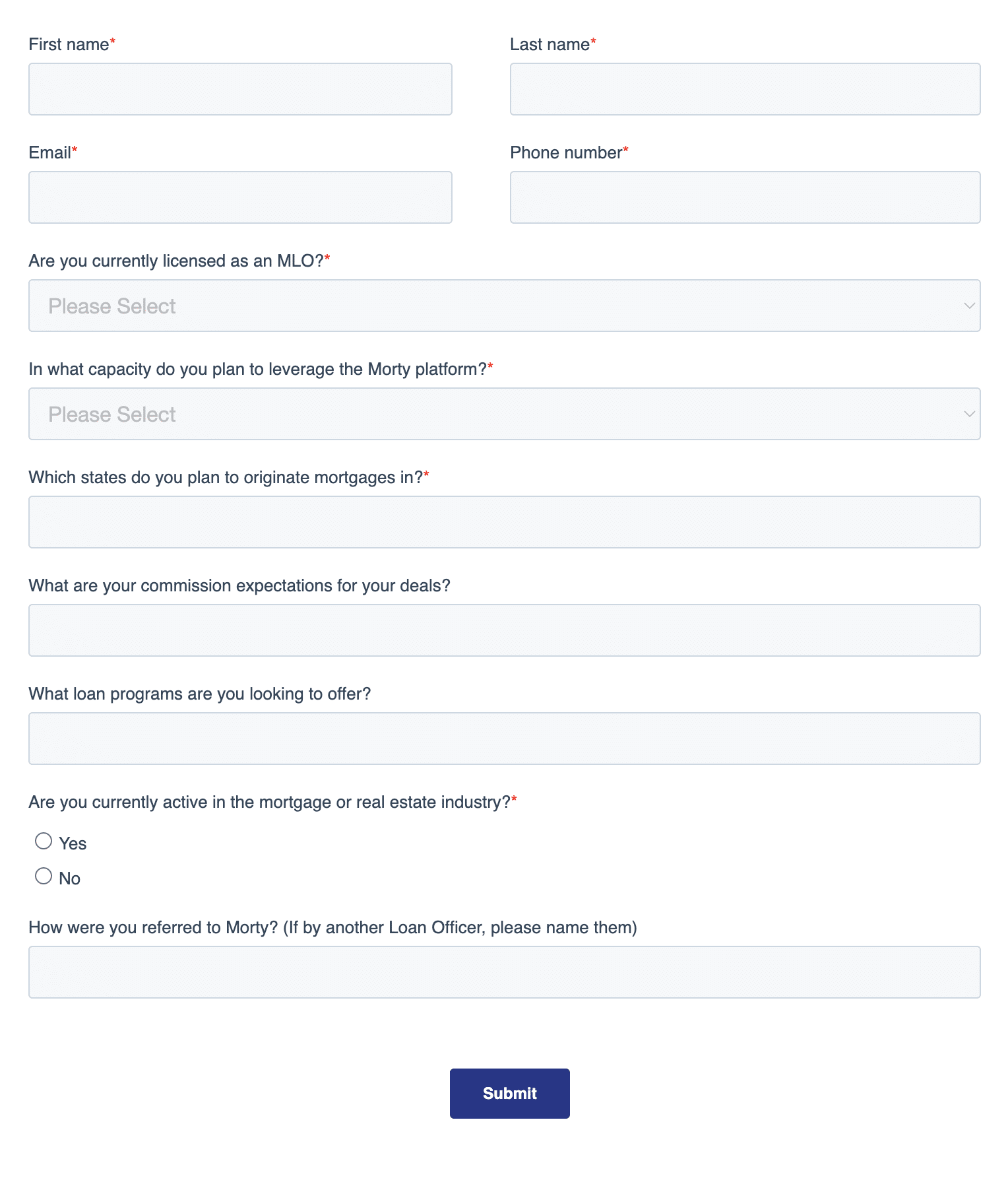

Navigating the licensing process for a mortgage brokerage in Pennsylvania requires diligence, education, attention to detail, time (up to a few months) and money. As an alternative to doing this all yourself, consider working with Morty to handle the licensing, compliance, and infrastructure while you focus on what matters most to you — your clients and growing your business. And with Morty you can be up and running with your mortgage business in as little as month!