If you’re a mortgage broker looking to start your own mortgage company, you’re in the right place. Before launching, start with a solid business plan—it’s your blueprint for long-term goals and operations. Once that’s in place, we’ll dive into your go-to-market (GTM) strategy, which is more time-bound and action-focused—think of it as the playbook for a successful launch. Let’s break down your GTM strategy into simple, actionable steps.

1. Identify Your Target Audience

Before you start your mortgage company, you need to define your ideal client. Who are they? What are their needs? Your audience might include:

- High-earning professionals looking to build wealth through real estate

- First-time homebuyers navigating the mortgage process for the first time

- Real estate investors interested in rental or multi-family properties

- Self-employed individuals or freelancers who need flexible loan solutions

- Military veterans or service members looking for VA loan options

By honing in on a niche, you ensure that your messaging and services align with a specific, high-intent audience.

2. Define Your Value Proposition

Your value proposition is why clients should choose your mortgage company over competitors. Depending on your audience, it could be:

- For high-income professionals: Exclusive access to off-market properties and streamlined mortgage solutions for busy buyers

- For first-time homebuyers: Hands-on guidance through every step of the process, helping them secure the best rates and loan terms

- For investors: A one-stop-shop with property sourcing, financing, and property management support

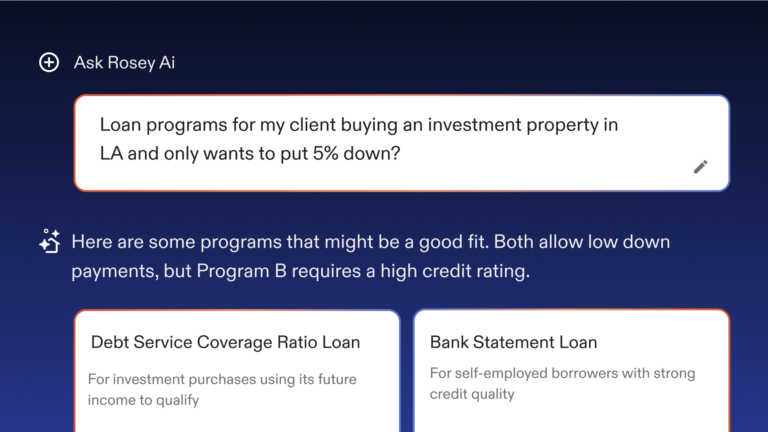

- For self-employed individuals: Specialized loan programs that consider alternative income documentation

- For veterans: A brokerage specializing in VA loans, ensuring military families get the best possible benefits

Clearly defining your value prop ensures you attract the right clients and solve their specific pain points.

3. Set Measurable Business Goals

When you start your mortgage company, you must have clear financial goals to remain profitable. For example:

- Break-even point: Closing three $1M+ deals per month

- Profitability: Doubling that number to six $1M+ deals per month would generate strong monthly profits

- Lead Conversion Rate: Aim for at least a 20% conversion from inquiries to closed deals

- Client Satisfaction: Maintain a 90%+ client referral rate

Tracking these Key Performance Indicators (KPIs) ensures that you can adjust strategies as needed to hit revenue targets.

4. Develop a Marketing Plan

A well-rounded marketing plan includes multiple approaches. Here are three different strategies you could implement:

Marketing Plan Option 1: Organic and Referral-Based Growth

This strategy relies on word-of-mouth, content marketing, and networking. It works best if you have strong connections in real estate or finance.

- Consistently post valuable content on LinkedIn, Instagram, and X to position yourself as an industry expert

- Start a blog or YouTube channel explaining mortgage processes, loan options, and market trends

- Build relationships with real estate agents, financial advisors, and CPAs to generate referrals

- Attend local networking events, real estate investment meetups, and homebuyer workshops

- Offer a referral bonus for past clients who bring in new business

This strategy is low-cost but requires time and effort to build momentum.

Marketing Plan Option 2: Paid Digital Advertising

For those with a marketing budget, paid ads can quickly drive leads. For example:

- Allocate $2,000 per month for Google and Facebook Ads targeting homebuyers and investors

- Use SEO to optimize your website for mortgage-related searches

- Run retargeting ads to follow up with website visitors who didn’t convert

- Partner with real estate influencers to promote your brokerage on social media

- Offer free webinars on mortgage strategies and advertise them through LinkedIn and YouTube ads

This strategy generates fast leads but requires ad optimization to ensure profitability.

Marketing Plan Option 3: Community Engagement and Partnerships

For brokers who thrive on local connections, a relationship-driven approach can be effective.

- Partner with homebuyer education programs to offer mortgage guidance

- Sponsor local real estate events or first-time homebuyer seminars

- Work with builders and developers to become their preferred mortgage partner

- Create a monthly newsletter featuring real estate market updates and financing tips

- Set up booths at home shows and financial planning expos to connect with potential clients

This strategy builds long-term brand trust and positions you as a go-to expert in your community.

5. Build a Strong Sales Pipeline

A well-defined sales pipeline ensures leads convert into closed deals. Here are three different sales pipeline structures based on business models:

Sales Pipeline Option 1: High-Touch, Relationship-Driven Approach

For brokers working with high-income professionals and real estate investors.

- Lead Generation: Clients come from referrals, networking, and direct outreach

- Initial Consultation: Personalized mortgage strategy call to discuss loan options

- Pre-Approval Process: Work closely with underwriters to secure pre-approvals quickly

- Property Search Support: Partner with real estate agents to help clients find properties

- Closing and Follow-Up: Ensure smooth transactions and encourage referrals

This approach focuses on trust and long-term client relationships, making it ideal for high-net-worth clients.

Sales Pipeline Option 2: Digital and Scalable System

For brokerages leveraging technology and automation.

- Lead Capture: Website form, paid ads, and social media campaigns

- Automated Pre-Qualification: Online tools to assess loan eligibility instantly

- CRM & Follow-Up: Automated emails and texts guiding clients through the mortgage process

- Dedicated Loan Officers: MLOs step in once the client is ready to shop for rates

- Performance Tracking: Dashboard with real-time deal tracking and weekly KPI reports

This model allows for higher lead volume while keeping operations efficient.

Sales Pipeline Option 3: Local & Community-Based

For brokers focused on homebuyer education and local partnerships.

- Lead Generation: Homebuyer workshops, in-person consultations, and real estate partnerships

- Educational Focus: Walk clients through mortgage options and financial planning

- In-Person Pre-Approval: Face-to-face meetings to secure financing and build trust

- Personalized Service: Assign dedicated MLOs to manage applications and closing

- Post-Closing Support: Stay in touch to encourage future referrals and repeat business

This strategy is best for brokers who want to be highly involved in their local market.

6. Track Performance and Optimize

Integrating real-time performance tracking ensures that you meet your goals:

- Custom Dashboards: Monitor monthly deal flow and progress toward financial targets

- Automated Reports: Weekly updates on how many more deals are needed to break even

- Data-Driven Adjustments: Optimize marketing and sales efforts based on conversion rates

By consistently analyzing performance, you can identify bottlenecks, adjust marketing spend, refine outreach strategies, and pinpoint areas where you can scale for greater impact.

Final Steps: Start Your Mortgage Company

With a well-defined audience, strong value proposition, measurable goals, and a structured sales pipeline, your mortgage company is positioned for success. By leveraging technology, staying data-driven, and balancing organic and paid growth, you set yourself up for consistent deal flow and long-term profitability.

If you’re looking to reduce startup costs and streamline operations, Morty can help—just like it has for other successful brokerages.