Starting a mortgage business in North Carolina presents a great opportunity to build an independent business, but navigating the process requires careful planning and adherence to regulatory requirements. In this comprehensive guide, we’ll walk you through the essential steps to establish your North Carolina brokerage. If you’re looking to become an individual mortgage broker in North Carolina, start first with our guide on how to become a license loan officer in North Carolina.

Research and Licensing

Before diving into setting up an independent mortgage brokerage in North Carolina, conduct thorough research on the legal and regulatory requirements in North Carolina. Obtain the necessary licenses to operate legally as a mortgage broker, as outlined by the North Carolina Commissioner of Banks (NCCOB). If you don’t already have your broker license, you can follow this step-by-step guide to licensing requirements for a mortgage brokerage in North Carolina.

Business Plan

Develop a comprehensive business plan outlining your brokerage’s goals, target market, marketing strategy, and financial projections. A well-thought-out mortgage broker business plan, built for North Carolina or your local community, will serve as a vital roadmap for your business.

Creating a business plan from scratch can be challenging. Morty can help with our Business Tiers, which can support you from solo mortgage entrepreneur to thriving North Carolina Mortgage Broker.

Establish Your Office

Find a suitable office space that complies with licensing requirements. If you prefer to meet with clients in person as part of your North Carolina mortgage business, you’ll want to create a professional environment for client meetings.

Build a Strong Team

Hire experienced and licensed mortgage professionals to assist in various aspects of your brokerage, ensuring a smooth workflow. With over 14,000 licensed loan loan officers in North Carolina, there are a lot of potential LOs to work with. Whether starting with one individual or leveraging Morty’s Platform offering for low-cost support, consider the optimal team size for your success.

Marketing and Networking

Create a robust marketing strategy to promote your brokerage. Begin locally by attending industry events and networking with professionals. Tailor your approach, exploring options like webinars, open houses, and community-focused content creation. Whatever you do, make sure it’s well executed and looks professional. Checkout these professionally designed open house flyers and personalized rack cards, crafted specifically for loan officers.

Develop Relationships with Lenders

As a North Carolina brokerage, you’ll need to establish partnerships with reputable lenders to offer a variety of mortgage products with competitive rates to your clients. There is a big range of lenders you can work with from regional banks to non-bank lenders to local credit unions. By joining the Morty Platform, gain immediate access to a vast lender network.

Leverage Technology

Incorporate technology into your operations for efficiency. Utilize customer relationship management (CRM) software, pricing engines a Loan Origination Software (LOS) and various online platforms to enhance services.

As part of the Morty Platform, you get day one access to our propriety technology, including our beautiful marketing pages, intuitive client portal and our loan officer facing LOS.

Compliance and Risk Management

Stay updated on state and federal regulations. Implement robust compliance and risk management protocols to protect your brokerage and clients. Include the submission of quarterly Mortgage Call Reports (MCR) to NMLS for a comprehensive overview of your lending activities. Morty offers support on compliance and regulatory matters as part of our Platform offering.

Provide Excellent Customer Service

Differentiate your brokerage by offering exceptional customer service. Build trust with clients for positive referrals and repeat business. Some great ways to ensure you’re giving the best service includes: strong first impressions, regular client check ins, clear product offerings, and great communication. You get all of these Morty!

Expand Your Brokerage Footprint

Once your brokerage is setup and thriving, you’ll begin to think about expanding beyond North Carolina. Other great markets to consider include Ohio, Florida and Georgia. With Morty, you can expand into as multiple markets with our Business Tier.

Working With Morty

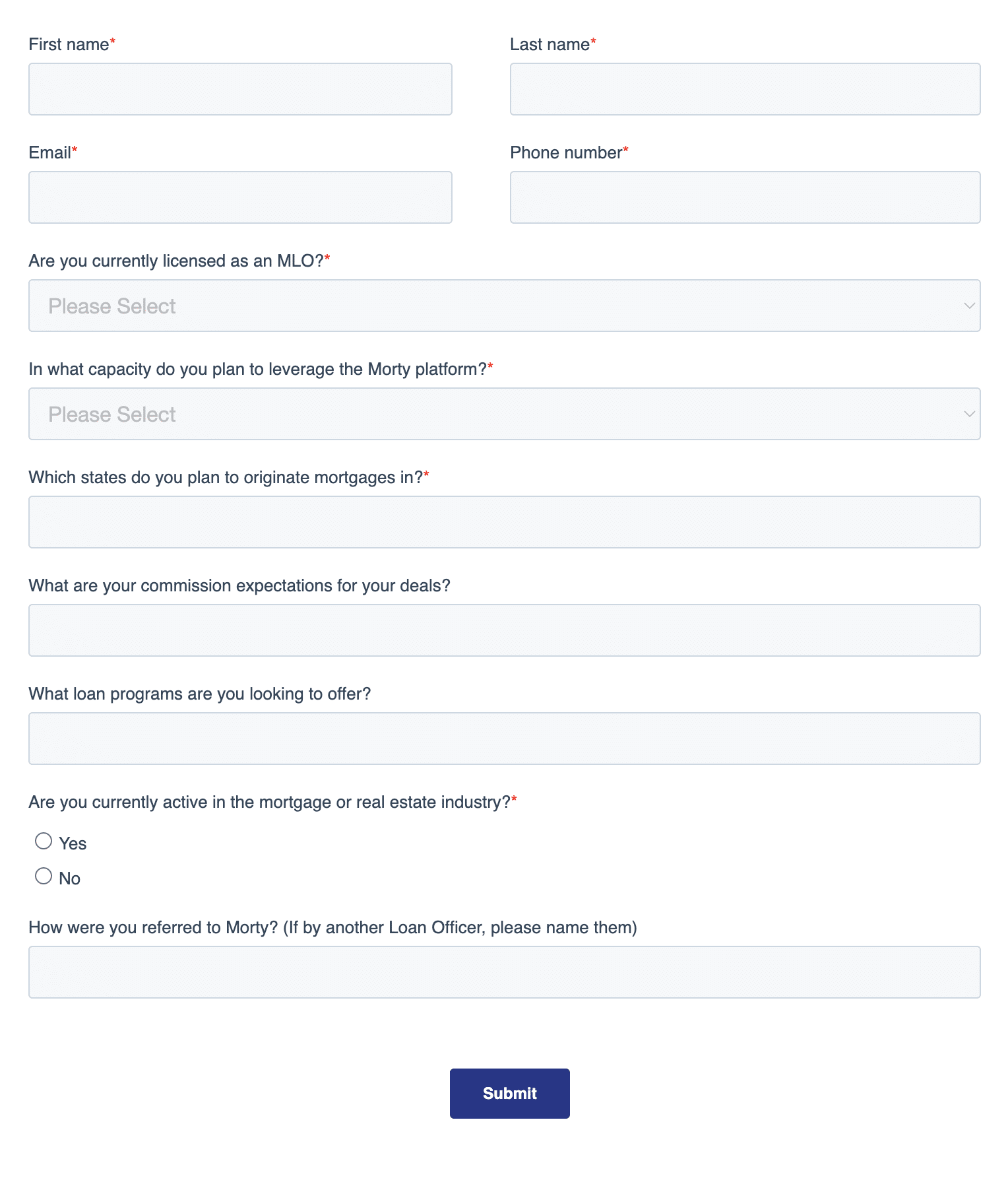

Being a North Carolina mortgage brokerage owner is an extremely rewarding career, but has numerous barriers to entry. It costs money and takes a lot of time to setup, taking away from your ability to serve your customers. That’s why we’ve offering ready-made solutions through our Business and Brokerage Tiers. Gain access to Morty’s technology, mortgage infrastructure, compliance experience, marketing library and Processing & Fulfillment team all with the ability to set your own compensation structures and support to build a powerhouse team. Reach out to us with any questions, or to schedule a demo!