Choosing the right mortgage platform is critical for loan officers looking to grow their business, streamline operations, and provide an exceptional borrower experience. Two leading platforms in the industry are Morty and Nexa Mortgage—but how do they compare?

In this guide, we’ll break down the key differences between Morty and Nexa Mortgage, helping you determine which platform best fits your mortgage business needs.

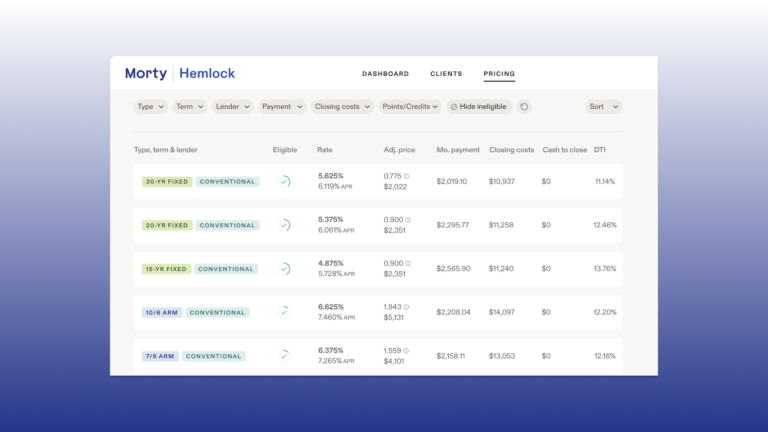

Morty: The All-in-One Platform for Loan Officers

Morty is designed to empower loan officers with automation, AI-driven tools, and built-in marketing solutions to help grow their business efficiently.

Key Benefits of Morty:

Nexa Mortgage: A Traditional Approach

Nexa Mortgage provides loan officers with a lender marketplace and brokerage management tools but lacks automation, AI-driven borrower assistance, and built-in marketing solutions.

Key Limitations of Nexa Mortgage:

|

Feature |

Morty |

Nexa |

|---|---|---|

|

Cost |

Starting at $129/mo. |

50 bps |

|

Real time mortgage rates | ||

|

AI-Powered Loan Concierge | ||

|

Underwriting support | ||

|

W-2 vs. 1099 | ||

|

Automated Workflows | ||

|

Free Marketing & Lead Generation tools | ||

|

Brokerage Management Tools | ||

|

Lender Marketplace & Loan Matching | ||

|

Scalability for Growth | ||

|

Client-Centric Digital Experience | ||

|

Free mentorship |

Which Platform Is Right for You?

If you’re looking for a modern, scalable, and automation-driven platform that helps you generate leads, streamline workflows, and enhance the borrower experience, Morty is the clear choice. Nexa Mortgage offers basic brokerage management tools but lacks the innovation and efficiency-boosting features that modern loan officers need.

Get Started with Morty Today

Ready to take your mortgage business to the next level? Sign up for Morty or book a demo to see how it can transform the way you work!