In a digital-first mortgage world, the tools you choose to run your business can make or break your productivity, compliance, and borrower experience. Independent mortgage brokers need platforms that do more than just check boxes—they need flexibility, scale, and real support to grow.

If you’re comparing Morty’s Brokerage Tiers with ARIVE, you’re already thinking strategically. Here’s how these two platforms stack up when it comes to helping you build a modern brokerage.

Feature Comparison: Morty Brokerage Tier vs. ARIVE

This table compares Morty’s Brokerage Tier offering against the ARIVE platform, focusing on features relevant to consolidating core technology (POS, LOS, PPE), streamlining compliance, and potential future operational needs.

| Feature / Service | Morty Brokerage Tier | ARIVE Platform |

|---|---|---|

| Core Technology (POS, LOS, PPE) | ||

| Integrated Suite (POS, LOS, PPE) | Yes (Proprietary, integrated stack) | Yes (Integrated stack with Lender Marketplace focus) |

| POS White-Labeling | Included (Branded with partner identity, hosted on partner domain) | Requires Pro Plan or higher (POS Themes) |

| LOS White-Labeling | Included (Assumed part of branding) | Requires Pro Plan or higher (Add logo) |

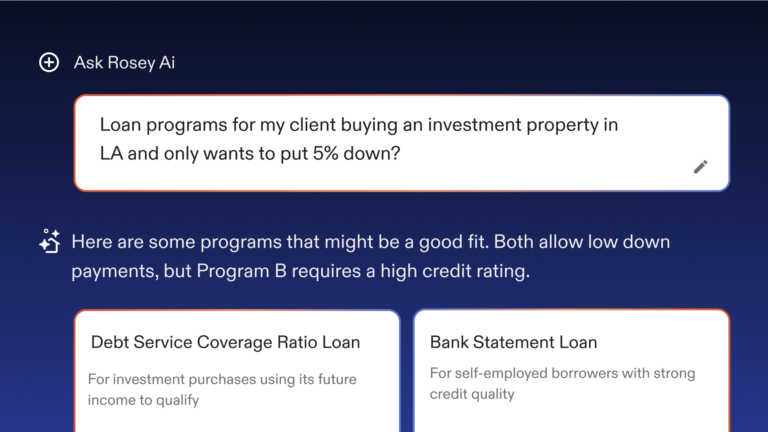

| Technology Approach | Proprietary platform, potential for unique features (e.g., AI mentions), focus on service enablement. | Tech-centric platform, frequent updates, deep lender/3rd-party integrations focus. |

| Compliance & Licensing Automation/Support | ||

| Compliance Policy Drafting | Optional Paid Service (Startup Package) | No Service Offered |

| Ongoing Compliance Management (Policy Maint., Reporting, Exam Support) | Optional Paid Service (Monthly Component) | No Service Offered (Relies on internal mgmt + tools) |

| Company Licensing Setup & Management | Optional Paid Services (Startup Package + Monthly Component) | No Service Offered |

| MLO Licensing Management | Optional Paid Service (Monthly Component) | No Service Offered |

| NMLS Call Report Generation | Yes (Managed via Compliance Service) | Yes (Built-in Tool – Core Plan+) |

| Compliant Digital Disclosures & Docs | Yes (Platform facilitates compliant digital disclosures & document packages) | Requires Non-Del Plan (via DocMagic Integration) |

| Compliance Approach | Service-Oriented: Outsource compliance tasks & management to Morty. | Tool-Oriented: Provides tools/integrations for internal compliance management (critical integrations require top tier). |

| Operations Support | ||

| Loan Processing & Fulfillment (P&F) | Optional Paid Service (Per Transaction Fee) | No In-House Service (Supports external Contract Processors via dedicated seat type) |

| Corporate Formation Assistance | Optional Paid Service (Startup Package) | No Service Offered |

| HR, Benefits, Payroll Setup Assistance | Optional Paid Service (Startup Package via preferred providers) | No Service Offered |

| Finance, Tax, Accounting Setup Assistance | Optional Paid Service (Startup Package via preferred providers) | No Service Offered |

| Operations Approach | Business Enablement: Offers services to set up and run core business operations beyond lending. | Technology Focus: Assumes brokerage handles non-lending operations externally. |

| MLO Recruiting Services | ||

| MLO Recruiting Support | Optional Paid Service Offered | No Service Offered |

| Service Model | ||

| Onboarding Assistance | High-Touch: Extensive optional paid services for business setup (branding, website, licensing, etc.) + dedicated Success Manager. | Standard Software Onboarding: Self-guided materials, community, chat/email support. |

| Ongoing Support | Service-Oriented: Optional paid managed services for operations (compliance, P&F, etc.) + dedicated Success Manager. | Technology Support: Standard platform support (chat/email), community forums, web resources. |

Key Takeaways

Technology Consolidation

Both platforms offer integrated POS, LOS, and PPE. Morty provides a proprietary suite with included white-labeling and built-in compliant disclosure capabilities. ARIVE offers integrations, but requires higher tiers for branding and specific compliance integrations (like DocMagic).

Compliance Streamlining

Morty offers comprehensive, optional managed services to handle compliance policy, reporting, licensing, and exam support, significantly reducing internal burden. ARIVE provides tools and integrations, but managing compliance remains an internal responsibility, and critical integrations require the most expensive tier.

Operational Flexibility

Morty’s optional P&F service allows you to outsource processing as needed, providing scalability. Morty also offers setup assistance for other core business functions (HR, Finance). ARIVE requires handling these functions internally or via third parties.

Partnership Model

Morty functions as a business enablement partner, offering extensive services beyond software, including MLO recruiting support. ARIVE acts primarily as a technology provider focused on workflow efficiency.

MLO Services

Morty offers optional paid services for both MLO Licensing Management and Recruiting Support, addressing potential future growth needs.

Choosing between Morty and ARIVE depends on whether you prefer a comprehensive service partner that can handle significant operational tasks (Morty) or a platform requiring more internal management (ARIVE), especially concerning compliance and non-lending operations.

Ready to Grow Your Brokerage?

If you’re ready to spend more time closing deals and less time managing systems, Morty’s brokerage tiers offer the structure, scale, and support to get you there.

👇 Get in touch and see how Morty can help build your brokerage, your way.