So, you’ve decided to become an independent mortgage broker—congrats! Whether you’re just starting out or looking to scale by upgrade your tech, the right tools can make all the difference. Investing in mortgage broker software helps streamline your workflow, manage client relationships, and keep your business running smoothly.

Independent mortgage brokers juggle a lot: client relationships, loan applications, pricing, compliance, marketing—you name it. The good news? The right mortgage tech stack can save you time, help you close more deals, and keep everything running smoothly.

Here are the 9 must-have tools every independent mortgage broker needs:

Loan Origination System (LOS)

A Loan Origination System (LOS) is the heart of your business. It handles loan applications, underwriting, and processing—all in one place. Without it, managing loans is a nightmare.

Popular options: Arive, Encompass, LendingPad

Point of Sale (POS) System

A Point of Sale (POS) system is where borrowers start the loan process. They fill out applications, upload documents, and track their loan progress. A good POS makes everything easy for your clients—and for you.

Popular options: Blend, Floify, SimpleNexus

Customer Relationship Management (CRM) Software

A CRM helps you manage leads, track follow-ups, and automate client communication. If you want to keep clients happy and stay top-of-mind, this is a must.

Popular options: Jungo, Surefire CRM, HubSpot

Pricing & Product Engine (PPE)

A PPE lets you compare mortgage rates and loan products across different lenders. Instead of manually checking rates, it automates the process so you can find the best options for your clients in seconds.

Popular options: Optimal Blue, Lender Price

Document Management & E-Signature Tools

Mortgage paperwork is overwhelming, but document management tools keep everything organized. They also allow clients to sign documents electronically—no more scanning and faxing.

Popular options: DocuSign, Adobe Acrobat Sign

Compliance & Audit Tools

Mortgage brokers have to follow a ton of rules (think TRID, RESPA, and CFPB). Compliance tools help you stay on track so you don’t run into legal trouble.

Popular options: QuestSoft, Ncontracts

Marketing & Lead Generation Tools

You need a steady stream of leads to grow your business. Marketing tools help you attract new clients through email, social media, and digital ads.

Popular options: MBS Highway, Homebot

Phone & Communication Systems

VoIP and SMS tools make sure you never miss a call or text from a client. A professional phone system is key for great customer service.

Popular options: RingCentral, CallRail, Vonage

Accounting & Commission Management Software

Tracking commissions and expenses manually is a pain. Accounting software helps you manage your money so you always know where you stand.

Popular options: QuickBooks, BrokerSumo

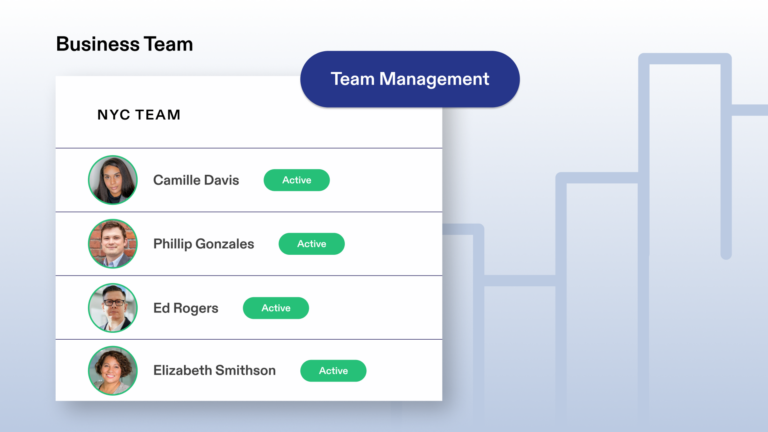

How is Morty Different?

Most mortgage broker software solutions require juggling multiple tools from different providers—often nine or more. That means managing multiple logins, dealing with complicated integrations, and paying for extra features you may not even need. The result? A system that’s more costly and inefficient than it should be.

At Morty, we simplify everything. Our all-in-one platform takes care of your POS, LOS, Marketing, PPE, and even integrates with your favorite CRM. Instead of paying for nine separate tools, you get one powerful system—for as little as $129/month.

- One login

- One system

- Everything you need to grow your mortgage business

Why overcomplicate things? Join Morty today and see how easy independent mortgage brokering can be.