As a successful loan officer, selecting the right Loan Origination System (LOS) can make or break your business. Your LOS is the backbone of your daily operations and client experience. With numerous options available, making the right choice requires careful consideration of your specific needs, budget, and growth plans. This guide will walk you through the key factors to consider when selecting an LOS that aligns with your business goals.

Understanding Your Needs First

Before diving into specific LOS options, take time to assess your business requirements:

- Volume expectations: How many loans do you anticipate processing monthly?

- Loan types: Do you specialize in conventional, FHA, VA, or non-QM loans?

- Client demographic: Are your clients tech-savvy or do they prefer traditional processes?

- Team size: Are you working solo or with processors and assistants?

- Growth plans: Do you intend to scale significantly in the coming years?

Your answers to these questions will guide you toward systems that align with your specific operational needs.

Key Features to Consider

User Interface and Experience

As an independent loan officer, you’ll likely handle multiple roles within the system. Look for an intuitive interface that minimizes training time and maximizes productivity. The best LOS for you should feel natural to use after minimal training.

Mobile Capabilities

In today’s on-the-go environment, mobile functionality isn’t just nice to have—it’s essential. Consider how often you work remotely and whether an LOS offers robust mobile options for both you and your clients.

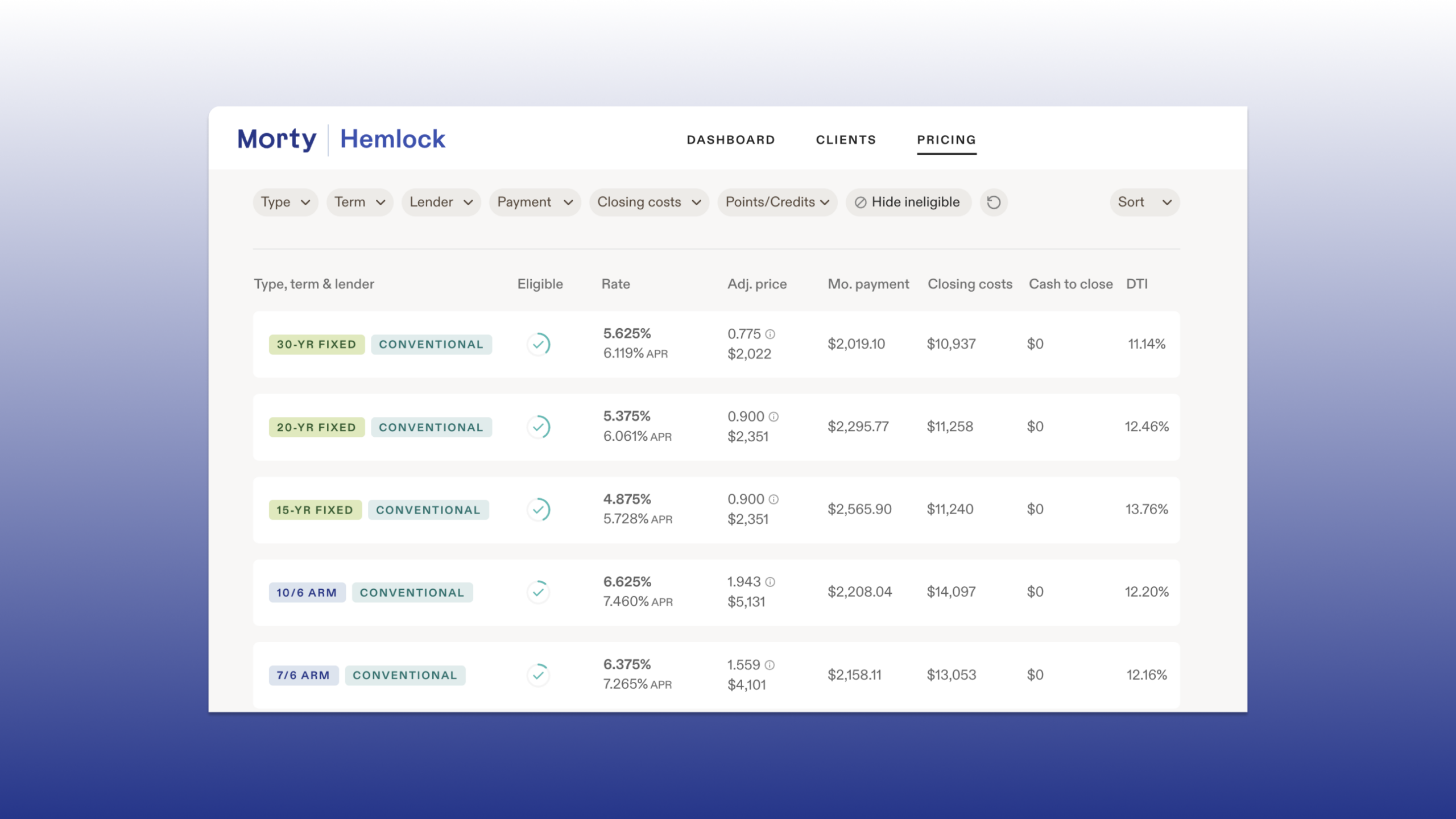

Integration Capabilities

Your LOS shouldn’t exist in isolation. It should seamlessly connect with:

- Pricing engine

- CRM systems

- Credit verification services

- Document storage solutions

- E-signature platforms

- Compliance tools

The strength of these integrations can significantly impact your workflow efficiency. Unlike other platforms, Morty’s LOS is an all-in-one platform, giving you everything you need at your fingertips.

Automation Features

Time is your most valuable asset. Look for systems that automate repetitive tasks such as:

- Document collection and verification

- Condition clearing

- Status updates

- Milestone notifications

Strong automation features can free you to focus on relationship building and business development.

Pricing Structure

As an independent operator, cost control is crucial. LOS pricing models typically include:

- Per-loan fees

- Monthly subscription costs

- Implementation fees

- Training costs

- Add-on feature charges

Consider your volume projections when evaluating costs, as some systems become more cost-effective at higher volumes while others are better suited for lower volume operations.

Compliance Support

Mortgage regulations are complex and ever-changing. Your LOS should offer robust compliance tools including:

- Automated compliance checks

- Regular regulatory updates

- Audit trails

- Compliant document generation

Strong compliance features protect both you and your clients.

Popular LOS Options for Loan Officers

While specific system recommendations may become outdated, some established platforms worth considering include:

Encompass by ICE Mortgage Technology: Comprehensive but can be costly for independents. Consider their broker-focused solutions.

Calyx Point: Long popular among independent originators for its balance of functionality and cost.

Byte Software: Offers flexibility and customization options suitable for independent operations.

Floify: Strong in document management and borrower experience, though more limited in some back-office functions.

LendingPad: Cloud-based with competitive pricing for independent operators.

Implementation and Transition Considerations

Once you’ve selected an LOS, consider:

- Training resources: What support is available to help you learn the system?

- Data migration: How will you transfer existing loan data?

- Timeline: Can you implement in phases to minimize business disruption?

- Backup plans: What contingencies exist if issues arise during transition?

Making Your Final Decision

Ultimately, the right LOS balances functionality, usability, cost, and support in a way that complements your specific business model. Consider requesting demos of your top contenders and ask about trial periods. Speak with other independent loan officers about their experiences, particularly those with similar business models.

Remember that no system is perfect—the goal is finding the LOS that best supports your unique approach to the mortgage business. The right system will grow with your business, adapt to market changes, and ultimately contribute to your success as an independent loan officer.

What specific LOS features would make the biggest difference in your daily operations?