Looking to become an MLO? Here’s our step-by-step guide to becoming a mortgage loan originator, aka a mortgage loan officer or MLO.

First, let’s review what is a loan officer and what do they do? A residential mortgage loan officer is a licensed professional who helps consumers obtain a mortgage or other type of home financing like a HELOC or HEL. Loan officers can specialize in certain loan types, but they’re able to support purchase, refinance and HELOC loans for primary, secondary and investment properties. As a mortgage loan officer, you will assist with loan applications, advise clients on different loan options, and manage the documentation process. Your role is pivotal in helping borrowers secure financing for a home purchase or refinance existing mortgages.

To become a mortgage loan officer you’ll need both a comprehensive understanding of the mortgage industry and financial regulations as well as good interpersonal and communication skills. You’ll need to learn the national and state-level guidelines and will be required to pass an exam to prove your mortgage knowledge and expertise. Once you pass your exam, you’ll get hired and sponsored by a mortgage company — this could be a mortgage broker like Morty, or a mortgage lender like a bank, credit union or non bank lender. Regardless of who you work for, the licensing process is the same.

Now let’s dive into our step-by-step guide of how to become a mortgage loan officer.

- Step 1: Request your NMLS account

- Step 2: Receive your personal NMLS ID number

- Step 3: Review all the state-specific licensing requirements

- Step 4: Complete both the national and state-specific mortgage coursework

- Step 5: Prepare for the national SAFE Test

- Step 6: Pass the national SAFE exam to become a licensed loan officer

- Step 7: Complete a background check and get fingerprinted

- Step 8: Complete and Submit your Individual (MU4) Form to NMLS

- Step 9: Get sponsored by a mortgage company, the final step to become a licensed MLO!

- Are you looking for sponsorship?

- Interested in getting licensed in multiple states?

- Learn about joining the Morty platform.

Step 1: Request your NMLS account

Start your journey to become an mlo by requesting an NMLS account through the Nationwide Multistate Licensing System & Registry (NMLS), which is also commonly referred to as the Nationwide Mortgage Licensing System.

Step 2: Receive your personal NMLS ID number

Once you’ve registered with the NMLS, you’ll receive an individual NMLS ID number. This unique identifier will be used throughout your career as a mortgage loan officer, regardless of which mortgage lender or mortgage broker you’re employed by and is sponsoring you. If you opted to get licensed in multiple states, the same NMLS ID will be used when registering in all of them.

Step 3: Review all the state-specific licensing requirements

Next, check the state-specific licensing requirements for the state that you’re planning to get licensed in. Morty has compiled state specific licensing guides to make things easier and more straightforward. You can also check out the the NMLS Resource Center, State Licensing for state specific licensing requirements.

Step 4: Complete both the national and state-specific mortgage coursework

Complete the required 20 hours of pre-licensing coursework. Pre-licensing classes for becoming a mortgage loan officer cover a range of topics from mortgage industry fundamentals and financial regulation to ethics and professional conduct. In some states, additional hours of work must be completed that are dedicated to state-specific laws and regulations. Morty recommends Oncourse Learning‘s pre license courses. If you’d like other recommendations, reach out through our Platform Loan Officer program.

Step 5: Prepare for the national SAFE Test

After you’ve completed your 20 hours pre license course and any additional state specific education, you’ll want to purchase your SAFE exam prep materials and practice tests to begin studying and getting ready for the Secure and Fair Enforcement (SAFE) exam. This exam was instituted by Congress as part of the Secure and Fair Enforcement for Mortgage Licensing Act, known as the SAFE Act, of 2008.

Step 6: Pass the national SAFE exam to become a licensed loan officer

To obtain your MLO license, you’ll need to pass the NMLS’s SAFE Mortgage Loan Originator Test with a score of 75% or higher. This exam is meant to test your understanding of core concepts in mortgage lending. The SAFE exam is 190 minutes long, and costs $110.

Schedule your SAFE test at your convenience and when you feel prepared. If you do not pass the SAFE exam, you’ll have to wait 30 days to take it again.

Step 7: Complete a background check and get fingerprinted

Before you officially have your loan officer license, you must complete a Criminal Background Check via your NMLS account. You must also make an appointment to have your fingerprints taken, which can also be arranged through the NMLS portal. The current cost of these checks is $36.25.

Step 8: Complete and Submit your Individual (MU4) Form to NMLS

Once you’ve passed your test and done your background checks, you’re ready to file your Individual (MU4) Form. Head to your NMLS portal to file your Individual (MU4) Form and pay your NMLS fees, which vary by state.

Step 9: Get sponsored by a mortgage company, the final step to become a licensed MLO!

After finding and being hired by a mortgage originator, that’s either a mortgage broker like Morty or a mortgage lender, you can initiate the sponsorship process by submitting the company’s credentials to the NMLS for verification. As soon as NMLS gives final approval — congrats, you officially have your mortgage loan originator license!

Are you looking for sponsorship?

If you’ve completed the pre license education courses and passed the SAFE exam to become a loan officer, the next thing to consider is what mortgage company will sponsor your license.

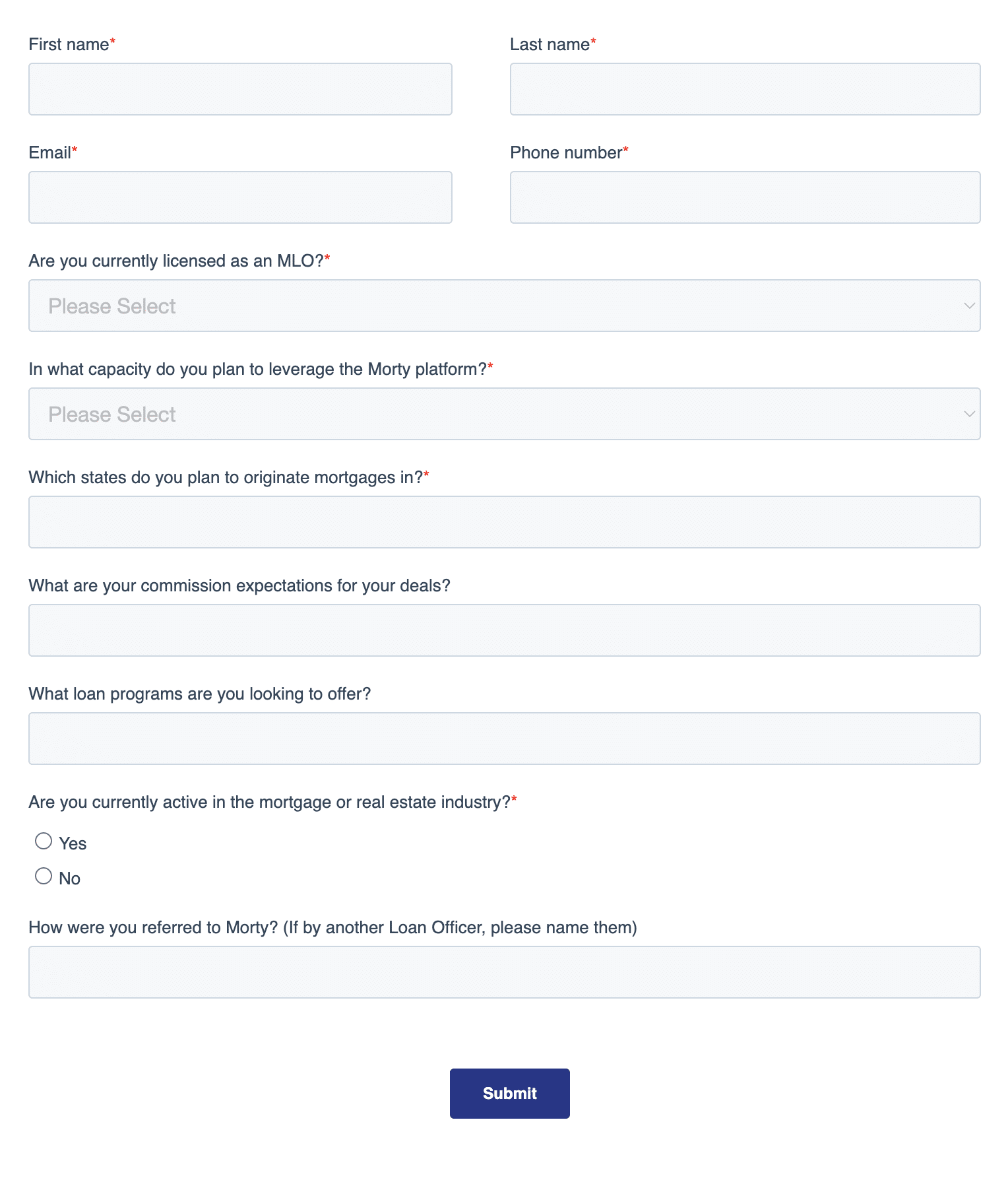

We’d love for you to be sponsored by Morty! Morty is a technology-enabled online mortgage broker. We make it quick and easy to for MLOs to get sponsored and work off our platform. Morty also offers loan officers, and their clients, a better, more seamless mortgage experience through our lender marketplace offering many types of loan, competitive pricing, affordability tools, underwriting technology, along with the built-in support from our processing and fulfillment teams.

Interested in getting licensed in multiple states?

Are you interested in getting your loan officer license in multiple states? To become licensed in multiple states, you’ll need to fulfill the additional education requirements for each state and file your Individual (MU4) Form for each state through NMLS.Morty is licensed in 45 states and can help you quickly get sponsored in multiple states. To help, we compiled mortgage licensing guides for many states including: Georgia, North Carolina, Florida and Ohio.

Learn about joining the Morty platform.

Morty makes it quick and easy to for licensed MLOs to get sponsored and work off our platform. Take a look at our Platform Business Tiers. These tiers are specifically designed to give you the independence to start or scale your mortgage brand with the resources, infrastructure and technology you need to be profitable in today’s mortgage industry.