With over 30 years of experience in the mortgage industry, Ron Radziminsky has seen it all—from fluctuating interest rates to shifting market trends. His journey from an aspiring medical student to a seasoned mortgage professional is one of opportunity, adaptability, and a passion for helping people achieve their homeownership dreams.

Ron Radziminsky

Mortgage Loan Officer NMLS ID #302517

A Career That Started by Chance

Ron’s entry into the mortgage industry wasn’t planned. Originally set on becoming a doctor, he found himself in Orange County, California, waiting tables for the summer. On his mother’s suggestion, he got his real estate license and responded to a newspaper ad looking for loan officers. What started as a summer job quickly became a lifelong career. “Once I started making a little bit of money, it was very difficult to go back to medical school,” Ron recalls.

The Power of Relationships in Mortgage Success

While Ron initially didn’t see himself as a salesperson, he quickly learned that being a good listener and building trust were key to success. “I’m actually very shy by nature, so I like to listen. People feel comfortable when you’re truly interested in what they need,” he says. This approach helped him excel in originating loans and establishing long-term client relationships. Some of his clients have returned for dozens of transactions over the years, a testament to his dedication and service.

Innovating in the Industry

Ron has been at the forefront of mortgage innovation. Early in his career, he worked with a company that pioneered no-closing-cost loans and mobile notaries—both of which revolutionized the lending process by making it easier and more accessible for borrowers. “People couldn’t believe they could do a loan with no closing costs and have someone come to their house to sign,” he recalls.

Navigating Interest Rate Fluctuations

Having witnessed interest rates ranging from 9% down to historic lows and back up again, Ron understands the importance of perspective. He advises homebuyers to focus on the bigger picture. “Interest rates are a tool to get into a home. Yes, you want a good deal, but locking in your housing payment and having the opportunity to refinance later is what truly matters,” he explains.

Building a Sustainable Mortgage Business

For those entering the mortgage industry, Ron emphasizes the importance of systems and consistency. “Let everyone know what you do, but don’t push it in their face. Build relationships, ask for referrals, and have systems in place for marketing and client communication,” he advises. He also stresses the value of sales training to refine communication skills and streamline the loan process.

Lessons from Commercial Lending

Ron’s experience extends beyond residential mortgages into commercial lending, which he describes as a different challenge altogether. “Residential is like making a widget—you follow a set process. Commercial is storytelling. You have to put the facts together and present a compelling case to investors,” he explains. For loan officers looking to expand into commercial lending, Ron recommends developing a deep understanding of property analysis and client needs.

The Future of Mortgage Lending

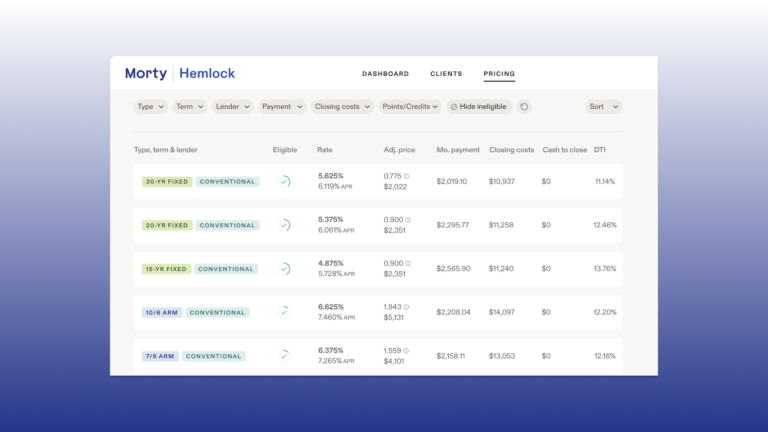

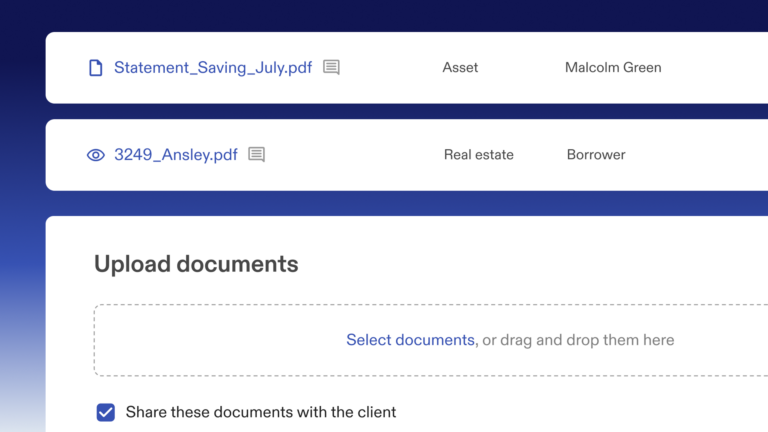

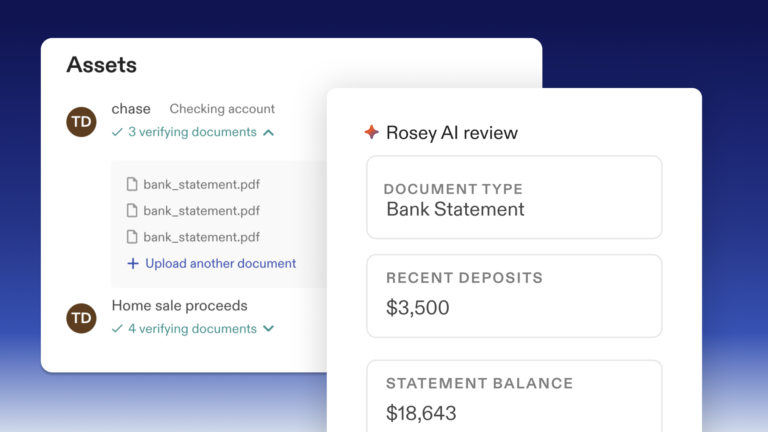

As someone always looking to stay ahead, Ron is intrigued by how technology is shaping the mortgage space. Platforms like Morty, which streamline the loan process, are making home financing more accessible than ever. “The industry is evolving, and having the right tools can make all the difference,” he says.

Final Advice: Focus on the Bigger Picture

For fellow loan officers, Ron’s advice is simple: build relationships, be adaptable, and invest in personal growth. “Real estate changes lives, and true wealth is developed through homeownership. If you can help people navigate that journey, you’ll build a rewarding and successful career.”

Ron’s journey is proof that success in the mortgage industry isn’t just about selling loans—it’s about understanding people, adapting to change, and always looking for new opportunities to grow.