How Rosey AI solves key pain points with real lender data you can trust

Every mortgage brokerage wants to scale efficiently—but that gets hard when your loan officers are constantly bottlenecked by questions they can’t easily answer. Product eligibility, guideline nuances, DPA requirements, lender overlays… the list goes on. And in most broker shops, getting clarity on those questions means digging through PDFs, pinging AEs, or asking around the office.

It’s inefficient, inconsistent—and it slows your team down.

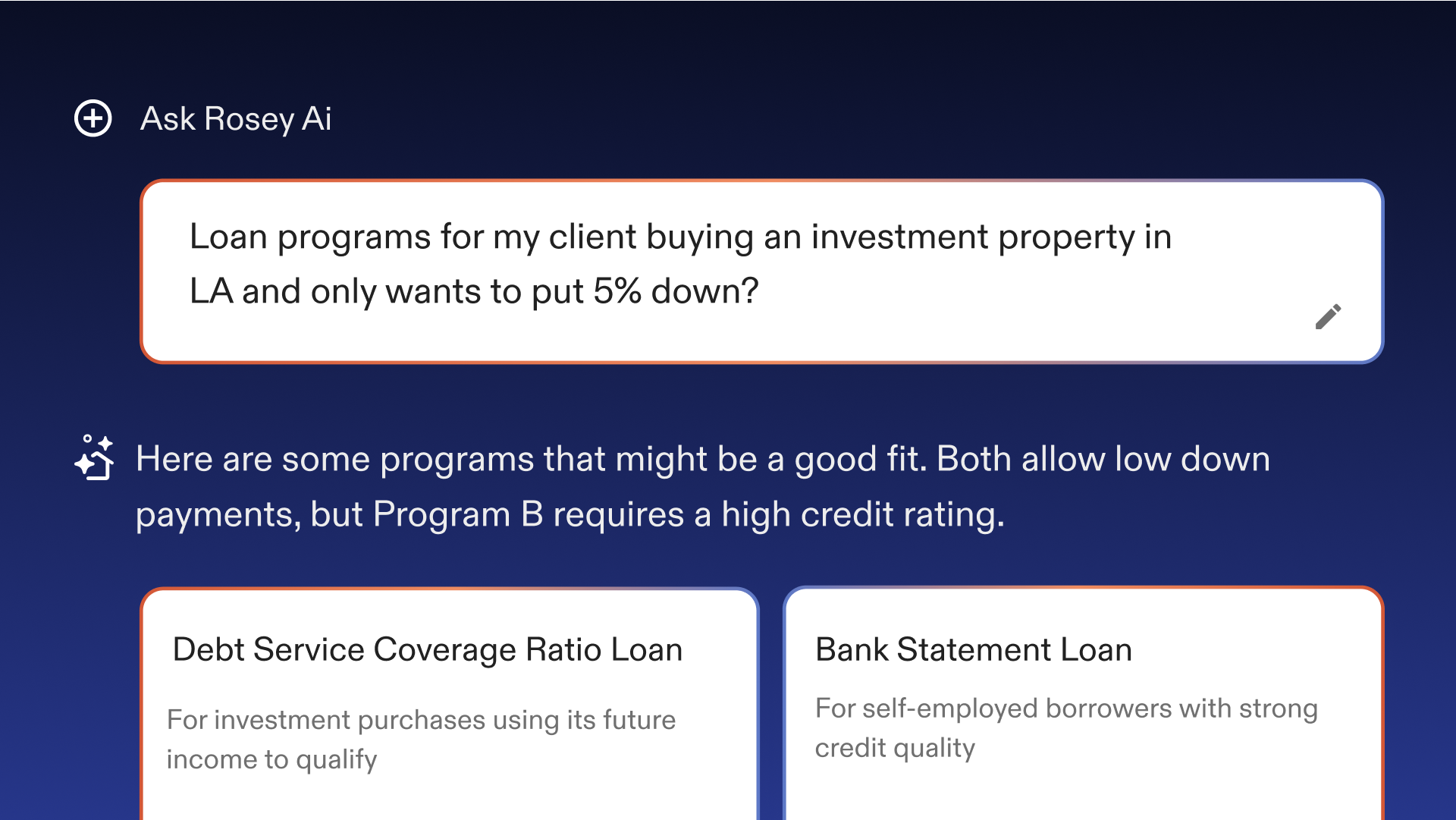

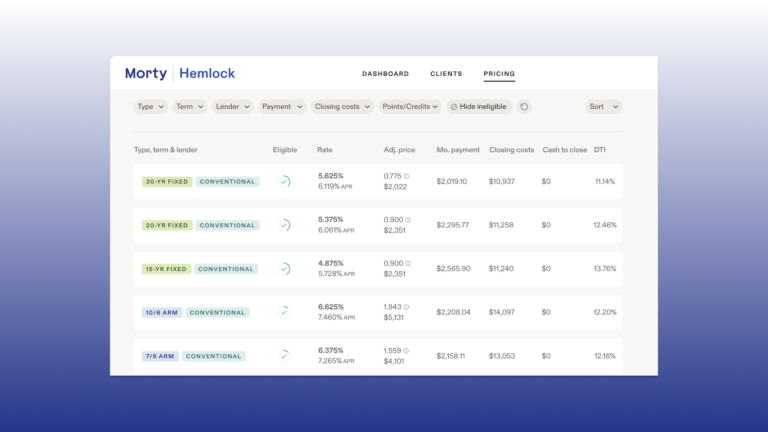

That’s why Rosey AI chat is such a game-changer for brokerages. Unlike generic AI tools, Rosey is trained on Morty’s proprietary lender and compliance data, making Rosey a trusted, secure source of truth for your loan officers—available 24/7 inside Hemlock.

The Brokerage Pain: Every Question Becomes a Bottleneck

When loan officers don’t have quick access to the right information, productivity suffers—and so does consistency. Here’s what brokerages are seeing every day:

- LOs guessing or delaying answers because they can’t find clear guidance.

- Senior staff constantly fielding repetitive product and guideline questions.

- Risk of quoting incorrect terms or submitting deals that won’t get approved.

- A disjointed borrower experience when communication breaks down.

These operational inefficiencies cost time, erode trust, and cap your brokerage’s ability to scale.

Rosey AI = Consistent, Compliant Answers at Scale

Rosey AI now includes a smart, conversational assistant that answers complex mortgage questions in real time—based on your actual lender and product guidelines, not AI guesswork. Your LOs can simply ask:

- “Is non-occupant co-borrower income allowed on this product?”

- “Does Lender Y require reserves for a second home?”

- “Can I combine this DPA with an FHA loan?”

And Rosey responds instantly, with compliant, lender-specific information—and links to supporting documents if needed.

Why This Matters for Brokers and Brokerages:

- ✅ Standardized, Reliable Information

When every LO has access to the same verified answers, you reduce variability and risk. No more “it depends” or relying on tribal knowledge. - ✅ Faster Training & Onboarding

New LOs ramp up faster when they can self-serve and learn through guided, real-time support—no need to shadow or wait for answers. - ✅ Reduced Compliance Risk

Rosey pulls from Morty’s proprietary lender database, so every answer is grounded in real, up-to-date data. Not ChatGPT guesses. - ✅ More Loans, Less Lag

With quick, accurate responses to even the most technical questions, LOs stay in their flow, keep clients engaged, and move loans forward faster. - ✅ Scalable Support Without More Headcount

Instead of building out a larger support team, Rosey helps you extend expert-level knowledge across your entire org.

Why Proprietary Data is the Game-Changer

Let’s be clear: not all AI is created equal.

Most AI chat tools rely on general web data or outdated public sources. That’s fine for trivia—but not for lending. With mortgages, the stakes are too high, and the rules too nuanced.

Rosey is different. She’s trained exclusively on Morty’s proprietary lender, product, and compliance data—the same info that powers our LOS, pricing engine, and product eligibility logic. That means:

- No hallucinations.

- No misinformation.

- Just fast, accurate answers you can trust.

Conclusion:

In a market where speed, accuracy, and compliance matter more than ever, brokerages need tools that work as hard as their loan officers. Rosey AI isn’t just a chatbot—it’s a scalable solution to a real operational pain point, built on the data that drives your business.

With Rosey, your LOs aren’t just guessing—they’re winning. Get in touch with our team below to learn more.