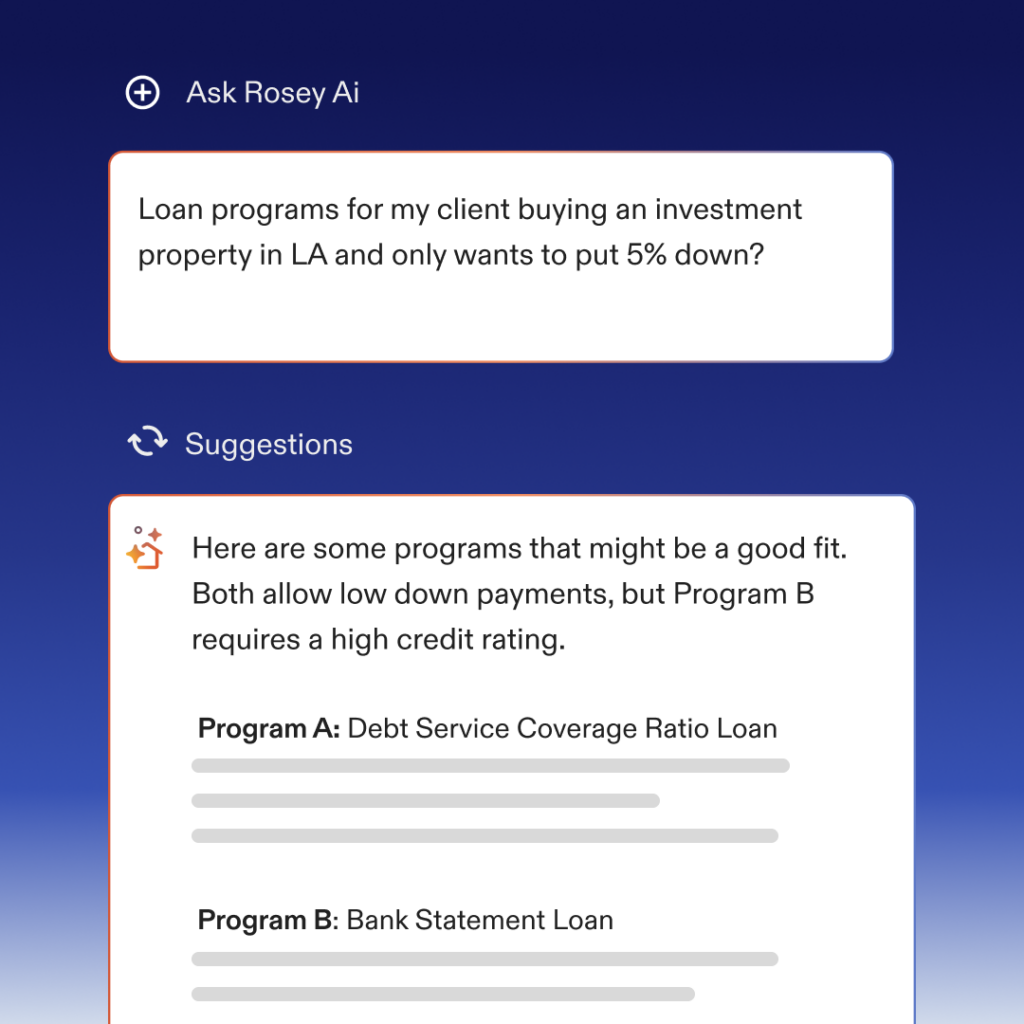

Get instant answers to tough loan questions, without digging through guidelines.

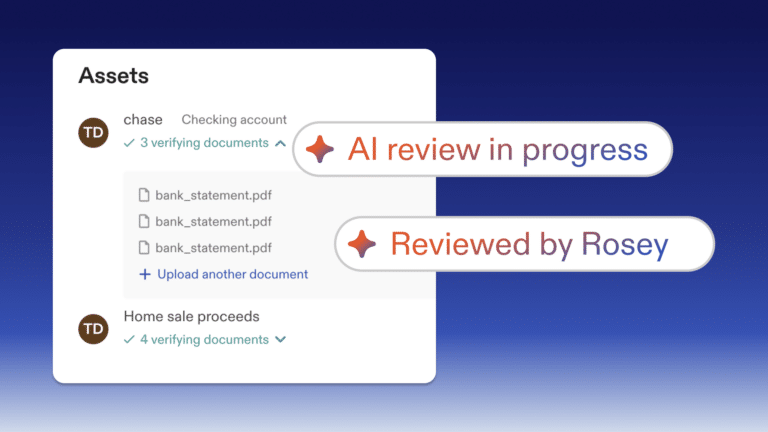

Last week, we announced how Rosey AI is helping loan officers verify documents faster. This week, Rosey is getting even smarter—and more helpful. Now, Rosey is ready to tackle one of the most time-consuming pain points in the mortgage process: digging through lender guidelines to answer complex loan questions.

Whether you’re navigating FHA eligibility, figuring out DPA qualifications, or wondering about lender overlays, Rosey has you covered—right inside Hemlock.

The Pain: Guideline Research is a Time Drain

Loan officers are constantly fielding questions from clients and partners that require quick, accurate answers—often buried deep in a maze of lender matrices, PDFs, and program guidelines. The process usually looks like this:

- Search for the latest version of a 100+ page guide.

- Cross-check different sources for accuracy.

- Double-check with a processor or AE to be sure.

- Hope you got it right before quoting or structuring the deal.

All of that takes time—and opens the door to mistakes or delays that can cost you the client.

The Fix: Rosey AI = Your On-Demand Guideline Expert

Rosey now functions as a secure, AI-powered chat assistant trained on Morty’s proprietary lender data and real-time program guidelines. That means you can ask questions like:

- “What’s the minimum FICO for FHA with Lender X?”

- “Does this DPA program allow gift funds?”

- “Are there income limits for this product?”

And Rosey will respond in seconds—with clear answers, lender-specific insights, and direct links to source documents when needed.

Rosey is trained on Morty’s real proprietary lender data and guidelines—no generic AI guesswork.

Get accurate answers to complex mortgage questions in seconds instead of digging through 100-page PDFs.

Solution files faster, and with better results. No more second-guessing—get clear answers with links to reference docs.

Why Loan Officers Love It

This new Rosey feature doesn’t just save time—it removes one of the biggest workflow headaches:

- ✅ Guideline Expert (Without the Guesswork):

No more second-guessing or flipping through outdated PDFs. Get clear, compliant answers backed by Morty’s own data. - ✅ Time Saver:

Complex mortgage questions that used to take 20+ minutes to research? Now answered in seconds. - ✅ Smart & Secure:

Unlike generic AI tools, Rosey is trained on Morty’s verified lender and compliance data—so you can trust the answers you’re getting. - ✅ Always Available:

Whether it’s early morning or late at night, Rosey is there when you need her—right inside Hemlock.

Conclusion

With Rosey AI, loan officers can stop digging and start doing. This new chat feature makes answering even the toughest mortgage questions faster, easier, and more accurate—so you can stay focused on closing more deals, not flipping through guideline docs.