Mortgage profits are shrinking—and the path to becoming an independent mortgage broker or opening your own brokerage is changing fast. According to National Mortgage News, loan origination costs have climbed, and profit margins are tighter than ever. Mortgage pros aren’t just battling rate swings—they’re also dealing with slow, outdated systems that make it tough to scale and compete. But that’s where the opportunity lies. The right technology is lowering the barrier to entry and fixing the inefficiencies. Morty is right there with you leading the charge.

Morty is changing the way people think about mortgages. By using smart technology and keeping things simple, Morty helps brokers move faster and smarter. It’s not just about getting a mortgage anymore—it’s about building a better business, creating more choice for buyers, and unlocking new growth in an old-school industry.

Making It Easier to Start a Mortgage Business

Starting a mortgage brokerage would cost upwards of $27,500. Needing to pay for professional services, licensing, technology, and more would make starting a brokerage a hefty initial investment.

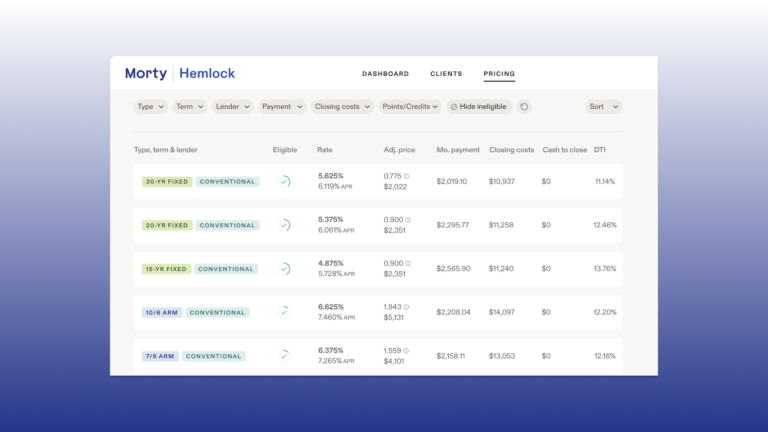

With Morty, new brokers get everything they need in one platform—from rate shopping to closing on the loan.That means lower startup costs, faster launches, and more support every step of the way. Morty’s platform helps small brokerages act big, offering tools and resources once reserved for large firms.

Brokers using Morty can access a wide range of lenders, track performance with real-time data, and focus on what matters: helping clients. That levels the playing field and makes room for more voices in the mortgage space.

Using AI to Save Time and Reduce Errors

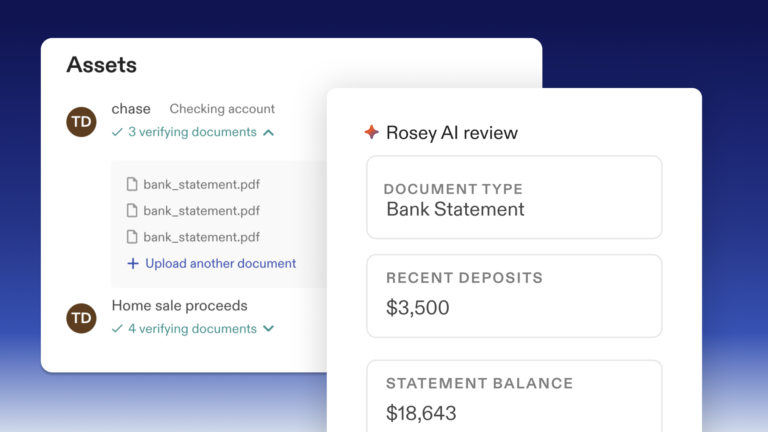

One of Morty’s biggest innovations is its AI-powered system called Rosey. Rosey helps instantly verify documents like pay stubs and bank statements. That speeds up the process and reduces mistakes.

By using AI and smart data tools, Morty can match buyers with lenders faster and help brokers close deals more efficiently. This kind of tech-driven support is what sets Morty apart and helps brokers stay competitive.

Supporting Brokers with Smarter Tools

Brokers using Morty get more than just software—they get a partner. Morty’s tools are designed to take the hassle out of running a brokerage. Brokers can have peace of mind by being able to stay on top of their business without drowning in paperwork.

Automation helps with back-office tasks, so brokers can focus on building relationships and helping buyers. That means more time doing what they love and less time managing spreadsheets.

Keeping Things Transparent and Easy to Understand

Morty believes in keeping things clear. The mortgage process is filled with jargon, fees, and fine print. Morty simplifies all of that.

Homebuyers get access to educational content, loan explainers, and tools that make the process easier to follow. Brokers, too, can benefit from this clarity—because when clients trust the process, they’re more likely to close with confidence.

What’s Next for Morty

The mortgage world is changing, and Morty is helping lead the way. With its focus on simplicity, support, and smart tech, Morty is opening doors for new brokers and giving homebuyers a better path forward.

Whether you’re starting a brokerage or just looking to improve how you work, Morty is here to help. The future of the mortgage industry is more open, more efficient, and more people-focused—and Morty is proud to be part of that story. Sign-up for a free strategy session with sales.