So, you’re thinking about becoming an independent mortgage broker, or maybe you already are and want to grow your business. Either way, having a solid mortgage broker business plan is key to setting yourself up for success.

A well-structured business plan helps you stay organized, attract clients, and secure funding if needed. But before we dive into how to create one, let’s break down two important things.

What Is a Business Plan?

A business plan for mortgage brokers is a document that outlines:

- Your goals – What you want to achieve.

- Your strategy – How you’ll reach those goals.

- Your services – What you offer and how you stand out.

- Your financial plan – How you’ll make money and grow.

Before writing a full mortgage broker business plan, many professionals create a business model canvas—a simple one-page tool that helps define your business structure, value, and market position. It’s a great way to organize your ideas before diving into the details.

Types of Mortgage Professionals

There are a lot of different jobs in the mortgage world, but to keep things simple, we’re focusing on three key roles. Understanding what they do will help make the whole process clearer:

Mortgage Banker – Lends money directly, using their own funds or borrowed funds.

Mortgage Broker – Works with multiple lenders to find the best mortgage for a borrower.

Mortgage Loan Officer – Works for a single bank or lender and offers only their loan options.

If you’re starting out as a mortgage broker, here’s how to create a mortgage broker business plan that sets you up for success.

Mortgage Broker Business Plan Template

Every mortgage broker business plan should include the following:

1. Executive Summary

Explain your mission, services, and what makes you different from competitors.

2. Company Description

Describe the problem you solve and why your services are valuable.

3. Market Analysis

Analyze industry trends, your target audience, and your competitors.

4. Organization & Management

Outline your business structure and leadership roles.

5. Service or Product Line

Define what services you offer and how they benefit your clients.

6. Marketing & Sales Strategy

Explain how you’ll attract, convert, and retain clients.

7. Funding Request (if needed)

If you’re looking for investment or funding, explain how much you need and how you’ll use it.

8. Financial Projections

Show expected revenue, profit, and long-term financial goals.

Mortgage Broker Business Plan: Example

To help put this all together, here’s an example of a mortgage broker business plan:

Executive Summary

ABC Mortgage Solutions helps first-time homebuyers find the best loan options by working with multiple lenders. Our goal is to simplify the mortgage process while securing competitive rates.

Company Description

The homebuying process can be overwhelming, especially for first-time buyers. ABC Mortgage Solutions provides personalized guidance, helping clients navigate loan options, understand rates, and close with confidence.

Market Analysis

The demand for homeownership is rising, but many borrowers struggle with high rates and complex requirements. Our business focuses on educating clients while providing flexible loan options.

Competitive Advantage: The current competitors in my market focus on second- and third-time homebuyers, leaving a gap in serving first-time homebuyers in the local area.

Marketing & Sales Strategy

We attract clients through social media, educational content, and partnerships with real estate agents. Our referral program rewards past clients for bringing in new business.

Financial Projections

In Year 1, we project $400,000 in revenue, with 15% growth year-over-year as we expand our client base and lender network.

How Morty Makes Building a Mortgage Business Easier

Building a mortgage brokerage is hard work, and most brokers end up paying for multiple tools and specialists to run their business. Many brokers pay separately for:

- A POS system

- A LOS system

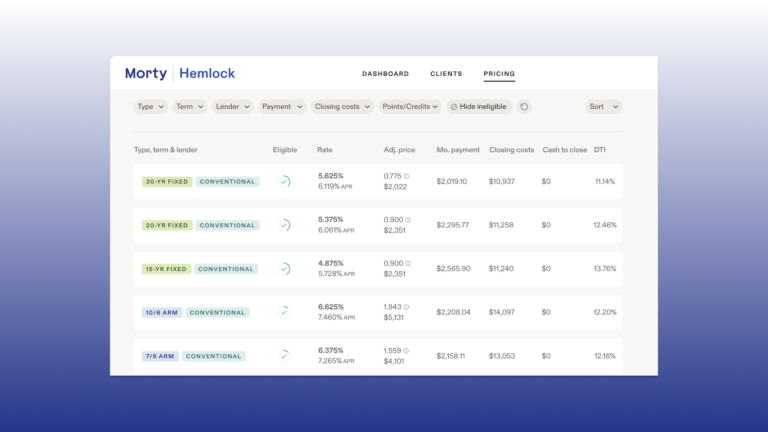

- A Pricing Engine

- Marketing

- A CRM

- Processing & Fulfillment

- Compliance

That means multiple subscriptions, logins, and extra costs.

With Morty, you get one powerful system that takes care of most of these needs—for as little as $129 per month.

- One login

- One system

- Everything you need to grow your mortgage business

Your mortgage broker business plan is the foundation of your success. Why overcomplicate things? Simplify your operations and scale faster with Morty’s all-in-one system.