Navigating the financial world can often feel like walking through a maze in the dark. For over a decade, Jovica Djurdjevic saw this firsthand as a wealth advisor, helping clients build resilient real estate portfolios. But it wasn’t until he experienced the mortgage process himself that he realized just how opaque and frustrating the mortgage industry could be. Catalyzed by this experience, Jovica vowed to bring the same level of strategic financial insight to mortgage lending that he had provided in wealth management.

Jovica Djurdjevic

Mortgage Loan Officer NMLS ID #2576017

Turning Frustration Into Action

“I was already advising clients on real estate deals, helping them underwrite investments, and making lender connections,” Jovica recalls. “But when I went through the mortgage process personally, I was stunned by the lack of communication and clarity.”

Jovica’s breaking point came when he was purchasing his current home. Despite meticulously calculating his ability to qualify for both his new and previous home loans, his lender dropped a bombshell just two weeks before closing: they weren’t sure he would qualify.

“I sat down, built a spreadsheet from scratch, and sent it over,” he says. “And they were like, ‘Oh, we didn’t catch that. You’re right.’ I thought to myself, ‘How is this possible?’”

This experience solidified his decision to take matters into his own hands. After years of consulting financial advisors on real estate deals, he became a licensed mortgage loan officer and joined the Morty Platform. His goal? To bring the same level of strategic financial insight to mortgage lending that he had provided in wealth management.

Breaking Down the Black Box

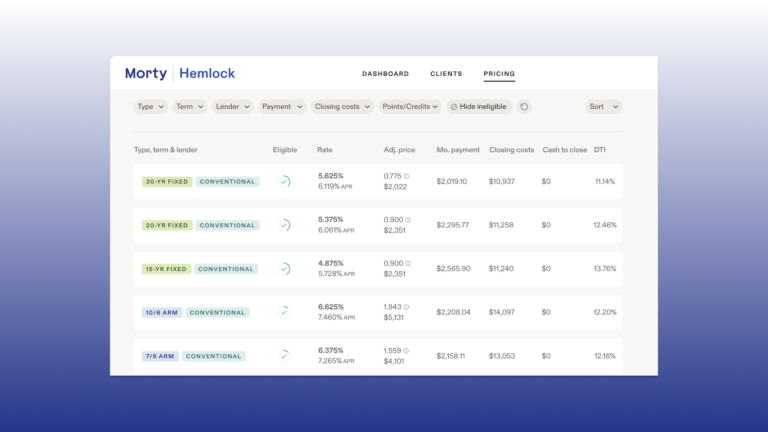

The mortgage industry has long been seen as a black box, where borrowers struggle to understand the factors that impact their eligibility. That’s why platforms like Morty resonate with professionals like Jovica, who believe in empowering both consumers and mortgage professionals with transparency and efficiency.

“In finance—whether it’s banking, financial advising, or mortgages—people just need clear explanations,” Jovica emphasizes. “The ability to get quick, accurate insights is critical. A DTI issue shouldn’t take days to figure out—it should take an hour, or even minutes.”

The Power of Knowledge and Technology

With over a decade of experience in wealth management, Jovica understands that the best financial decisions come from knowledge. He advises new mortgage professionals to embrace continuous learning, whether through platforms like “YouTube university”, AI tools, and hands-on experience structuring deals.

“If you don’t know what an asset depletion loan is, go spend 30 minutes learning about it,” he says. “The licensing exams are just a formality. Real expertise comes from solving real-world problems.”

To build his book of business, Jovica leverages his network and works with family offices and high-net-worth clients, structuring complex deals that require creative financing solutions. His background in wealth advising gives him a unique edge, making him a trusted partner for financial professionals seeking mortgage expertise.

Educating Through Content

In addition to working with clients, Jovica is passionate about sharing financial knowledge. He creates educational YouTube videos for clients to simplify complex financial concepts, driven by the frustration of not finding the information he needed when he was starting out.

“YouTube is incredible. Even if no one watches, I’m happy just putting valuable insights out there,” he says. “It’s about reducing friction in my life and helping others navigate the same challenges I faced.”

Advice for Other Mortgage Professionals

For those looking to start or grow their career in mortgage, Jovica’s advice is simple: embrace learning, lean into your natural skills, and start before you feel ready.

“Don’t overthink it. Your first few videos or deals won’t be perfect, and that’s okay,” he says. “The key is to start, make mistakes in private, and improve over time.”

By combining his financial expertise with a commitment to transparency, Jovica is not just closing deals—he’s reshaping the mortgage experience for clients and professionals alike. His journey is a testament to the power of knowledge, adaptability, and the drive to make financial systems work better for everyone.