Mortgage officers play a key role in helping clients secure financing, guiding them through the myriad options when it comes to both purchasing and refinancing homes. To remain effective and responsive to client needs, a deep understanding of the key mortgage types and refinancing options is crucial. Let’s dive into the different loan types that you’ll frequently encounter.

Purchase Mortgages: Laying the Foundation for Homeownership

1. Conventional Loans

- Conforming Loans: Guided by Fannie Mae and Freddie Mac standards, these are well-suited for borrowers boasting robust credit histories.

- Non-conforming or Jumbo Loans: Essential in higher-value real estate markets, these exceed the usual borrowing parameters due to their higher value.

2. Government-Backed Loans

- FHA Loans: Especially attractive to first-time buyers, FHA loans come with lower down payments and more flexible credit criteria.

- VA Loans: Tailored to veterans, active-duty personnel, and select military families, these loans often feature no down payment and no private mortgage insurance (PMI).

- USDA Loans: Designed for properties in qualifying rural areas, they can offer minimal or even no down payment requirements.

3. Specialized Purchase Solutions

- Adjustable-Rate Mortgages (ARMs): With rates that adjust over time, these might be a fit for those expecting increased future earnings or those considering a move before rates shift.

- Construction Loans: For those wanting to craft their homes from scratch, these provide initial funding and typically convert to a standard mortgage post-construction.

Refinancing Options: Reassessing and Optimizing Your Mortgage

- 1. Rate-and-Term Refinancing: The most common type, this lets homeowners save money or adjust the term of their loan without changing the loan amount.

- 2. Cash-Out Refinancing: This allows homeowners to refinance their mortgage for more than they owe and pocket the difference, often used for consolidating debts or home improvements.

- 3. Cash-In Refinancing: Here, borrowers bring money to the closing to reduce their mortgage amount, often aiming to eliminate PMI or qualify for better rates.

- 4. Streamline Refinancing: Offered by the FHA, VA, and USDA, this option makes it simpler for homeowners to refinance at lower rates with minimal documentation.

Being a mortgage officer requires more than just transactional knowledge; it demands a deep understanding of both purchasing and refinancing loan options. By being well-versed in the options above, officers can better serve their clients and fulfill their unique homeownership or refinancing needs.

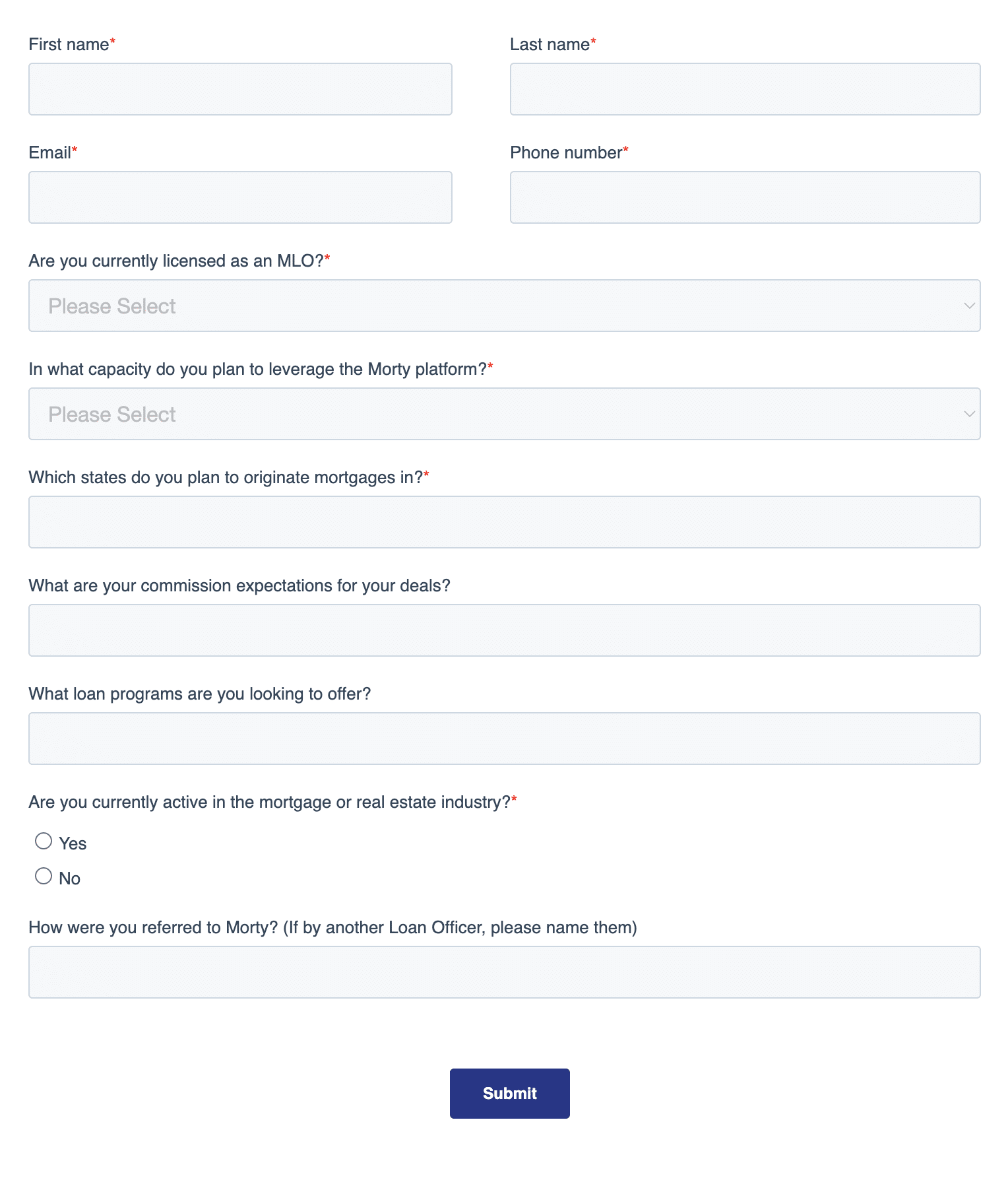

Are you looking for mortgage sponsorship so you can start working as a loan officer and offering these loan options to your clients?

Morty is a tech-enabled online mortgage broker. Working as an mlo at a mortgage broker means you have access to more loan options than a traditional lender through our vast lender marketplace. As part of our platform, you’ll also have access to our affordability tools, underwriting technology, and support from our processing and fulfillment teams.

We’re here to help you, the mlo, succeed — we’ll even reimburse you for the fees associated with pre-licensing, exams and applications after you’ve been sponsored and fully onboarded onto the Morty’s platform.

Learn about joining the Morty platform.

Morty makes it quick and easy to for licensed MLOs to get sponsored and work off our platform. Take a look at our Platform Business Tiers. These tiers are specifically designed to give you the independence to start or scale your mortgage brand with the resources, infrastructure and technology you need to be profitable in today’s mortgage industry.